How Small Businesses in Kenya Benefit from Cyber Insurance

In today’s digital landscape, where technology plays an integral role in business operations, the threat of cyberattacks looms larger than ever. Cyber insurance has emerged as a critical tool for small businesses in Kenya, providing essential protection against the financial repercussions of data breaches and cyber incidents.

As the reliance on digital infrastructure grows, so does the need for robust risk management strategies, making understanding how small businesses in Kenya benefit from cyber insurance more important than ever.

What is Cyber Insurance?

Cyber insurance, also known as cyber liability insurance, is a type of coverage designed to protect businesses from financial losses resulting from cyberattacks or data breaches. This insurance can cover a variety of incidents, including malware attacks, phishing scams, ransomware incidents, and denial-of-service attacks. For small businesses in Kenya, where digital transactions and online services are increasingly common, having a cyber insurance policy can mean the difference between recovery and financial ruin following a cyber incident.

The increasing frequency of cyberattacks is alarming. According to data from the Central Bank of Kenya (CBK), hacking incidents targeting financial institutions rose nearly three-fold to 444 million in the year ending June 2022. This surge highlights the urgent need for small businesses to safeguard their operations through effective risk management solutions like cyber insurance.

Overview of Increasing Cyber Threats

Small businesses are particularly vulnerable to cyber threats due to limited resources and cybersecurity expertise. A report by Kaspersky indicates that small businesses in Kenya experienced a 47% increase in cyberattacks in 2022. Unfortunately, many business owners remain unaware of the risks they face; over 90% reportedly do not recognize their exposure to growing cyber threats. This lack of awareness can lead to devastating consequences when an attack occurs.

By investing in cyber insurance, small businesses can not only protect themselves financially but also enhance their overall cybersecurity posture through access to risk management services often included in these policies. This introduction sets the stage for understanding how small businesses in Kenya benefit from cyber insurance by defining key terms and highlighting the relevance of this coverage in the context of increasing cyber threats.

The Importance of Cyber Insurance for Small Businesses

Why Do Small Businesses Need Cyber Insurance?

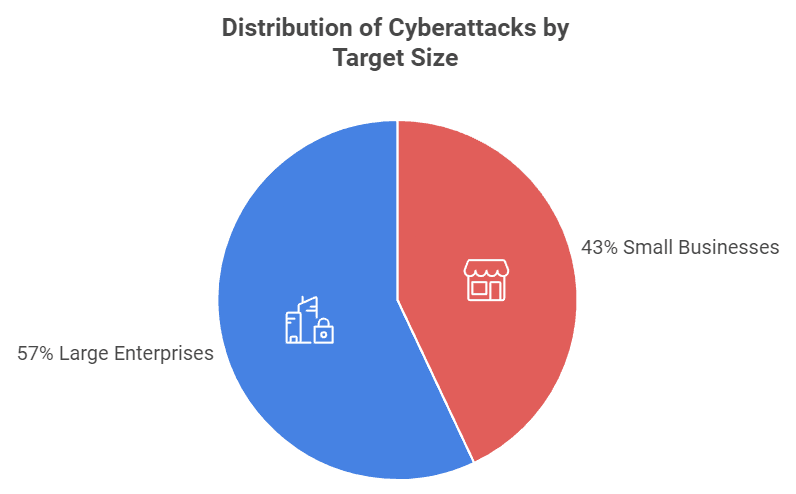

The necessity of cyber insurance for small businesses in Kenya cannot be overstated. As digital operations become more prevalent, so do the risks associated with them. Many small business owners mistakenly believe that they are not targets for cybercriminals, but this is a dangerous misconception. In fact, 43% of cyberattacks target small businesses, according to a report by Verizon. This statistic underscores the vulnerability of smaller enterprises, which often lack the resources to implement comprehensive cybersecurity measures.

Statistics on Cyberattacks Targeting Small Businesses in Kenya

- 47% increase in cyberattacks on small businesses in Kenya in 2022.

- Over 90% of small business owners are unaware of their exposure to cyber threats.

- The average cost of a data breach for small businesses can reach up to $200,000, which can be devastating for those operating on tight margins.

The Financial Impact of Cyberattacks

The financial repercussions of a cyberattack can be catastrophic for small businesses. A data breach not only incurs immediate costs—such as forensic investigations, legal fees, and public relations efforts—but also long-term damages, including loss of customer trust and potential regulatory fines.

For example, in 2021, a small retail business in Nairobi suffered a significant data breach that exposed customer payment information. The incident led to a $150,000 loss due to legal fees and compensation claims from affected customers. Additionally, the business experienced a 30% drop in sales over the following months as customers lost trust in their ability to protect sensitive information.

Conclusion: The Need for Proactive Measures

Given the alarming statistics and real-world consequences of cyber incidents, it is clear that small businesses in Kenya must prioritize cybersecurity. Cyber insurance serves as a vital safety net that not only protects against financial losses but also helps businesses recover more quickly from incidents. By understanding the importance of cyber insurance, small business owners can take proactive steps to safeguard their operations and ensure long-term sustainability. This section emphasizes the critical need for cyber insurance among small businesses in Kenya by presenting relevant statistics and real-life examples that illustrate the potential financial impact of cyberattacks.

Types of Cyber Insurance Coverage Available

Understanding the types of cyber insurance coverage available is essential for small businesses in Kenya as they seek to protect themselves from potential cyber threats. Cyber insurance policies typically fall into two main categories: first-party coverage and third-party coverage. Each type offers distinct benefits that can be tailored to the specific needs of a business.

a. First-Party Coverage

First-party coverage is designed to protect a business from direct losses incurred as a result of a cyber incident. This type of coverage typically includes:

- Data Restoration Costs: Coverage for expenses related to restoring lost or compromised data, including hiring forensic experts to recover data.

- Business Interruption Losses: Compensation for lost income during the downtime caused by a cyber incident, ensuring that the business can continue to operate after an attack.

- Cyber Extortion: Protection against ransomware attacks, including costs associated with paying ransoms and negotiating with cybercriminals.

- Notification Costs: Expenses related to notifying affected customers and stakeholders about a data breach, which may be required by law.

For example, if a small e-commerce business experiences a ransomware attack that locks them out of their systems, first-party coverage can help cover the costs of data recovery and any lost revenue during the downtime.

b. Third-Party Coverage

Third-party coverage protects businesses from liabilities arising from claims made by customers, partners, or other third parties affected by a cyber incident. This type of coverage typically includes:

- Legal Defense Costs: Coverage for legal fees incurred when defending against lawsuits related to data breaches or privacy violations.

- Regulatory Fines and Penalties: Protection against fines imposed by regulatory bodies for failing to protect customer data or comply with data protection laws.

- Settlements and Damages: Compensation for settlements or damages awarded to third parties as a result of a data breach.

For instance, if a small accounting firm inadvertently exposes client financial information due to a cyberattack, third-party coverage would help cover the legal fees and any potential settlements resulting from lawsuits filed by affected clients.

c. Combined Coverage

Many insurers offer combined policies that include both first-party and third-party coverage. This comprehensive approach allows small businesses to have robust protection against various risks associated with cyber incidents. By opting for combined coverage, businesses can ensure they are safeguarded against both direct losses and liabilities arising from third-party claims.

Conclusion: Tailoring Coverage to Business Needs

When considering cyber insurance, small businesses in Kenya should assess their unique risks and operational needs. Understanding the differences between first-party and third-party coverage is crucial for selecting the right policy. By tailoring their insurance coverage appropriately, small businesses can effectively mitigate potential financial losses stemming from cyber incidents. This section provides an in-depth look at the various types of cyber insurance coverage available to small businesses in Kenya, highlighting their specific benefits and real-world applications.

Key Benefits of Cyber Insurance for Small Businesses

Cyber insurance offers a multitude of benefits that can significantly enhance the resilience and sustainability of small businesses in Kenya. As cyber threats continue to evolve, having a comprehensive insurance policy can provide peace of mind and financial security. Here are some of the key advantages that small businesses can gain from investing in cyber insurance.

Financial Protection

One of the primary benefits of cyber insurance is its ability to provide financial protection against the significant costs associated with cyber incidents. The average cost of a data breach for small businesses can be staggering, often exceeding $200,000 when factoring in legal fees, regulatory fines, and lost revenue. Cyber insurance helps mitigate these costs by covering:

- Data recovery expenses, including forensic investigations.

- Business interruption losses, ensuring that income is preserved during downtime.

- Cyber extortion payments in cases of ransomware attacks.

For example, a small hotel in Kenya that falls victim to a cyberattack may incur substantial costs related to data recovery and customer notification. With cyber insurance, these expenses could be covered, allowing the business to recover more quickly without crippling financial strain.

Legal Support and Compliance

As data protection regulations become more stringent globally, small businesses must navigate complex legal landscapes. Cyber insurance provides essential legal support by covering:

- Legal fees associated with defending against lawsuits resulting from data breaches.

- Regulatory fines imposed by authorities for non-compliance with data protection laws such as the Data Protection Act in Kenya.

By having a robust cyber insurance policy, small businesses can ensure they are prepared for potential legal challenges arising from cyber incidents. This support not only protects their finances but also helps maintain compliance with evolving regulations.

Risk Management Services

Many cyber insurance policies offer additional risk management services designed to enhance a business’s cybersecurity posture. These services may include:

- Cybersecurity assessments to identify vulnerabilities within the organization.

- Employee training programs focused on recognizing phishing attempts and other cyber threats.

- Incident response planning to ensure a swift and effective reaction to potential breaches.

For instance, a small manufacturing company could benefit from risk management services that help them identify weak points in their cybersecurity strategy, thereby reducing the likelihood of a successful attack.

Business Continuity

In the event of a cyber incident, maintaining business continuity is crucial for minimizing disruption and financial loss. Cyber insurance plays a vital role in ensuring that businesses can recover quickly and resume operations. Coverage for business interruption losses allows companies to continue functioning even when their systems are compromised.For example, if a small retail store experiences a data breach that disrupts its online sales platform, cyber insurance can help cover lost revenue during the downtime while also funding recovery efforts.

Conclusion: Empowering Small Businesses

The benefits of cyber insurance extend far beyond mere financial protection. By providing legal support, risk management services, and ensuring business continuity, cyber insurance empowers small businesses in Kenya to navigate the complexities of the digital landscape with confidence. Investing in this coverage not only safeguards against potential losses but also fosters a proactive approach to cybersecurity. This section outlines the key benefits of cyber insurance for small businesses in Kenya, emphasizing financial protection, legal support, risk management services, and business continuity.

Understanding the Cost of Cyber Insurance

When considering cyber insurance, small businesses in Kenya must also understand the associated costs. The price of a cyber insurance policy can vary widely based on several factors, including the size of the business, the level of coverage required, and the specific risks faced by the industry. This section will explore these factors and provide insights into what small businesses can expect regarding premiums.

Factors Influencing Premium Costs

Several key factors influence the cost of cyber insurance premiums for small businesses:

- Business Size: Larger businesses with more extensive operations and higher revenue may face higher premiums due to increased exposure to risk. Conversely, smaller businesses may benefit from lower rates, but they still need adequate coverage to protect against potential losses.

- Industry Type: Certain industries are more prone to cyber threats than others. For example, businesses in finance, healthcare, and e-commerce often face higher premiums due to the sensitive nature of the data they handle. In contrast, a small retail store might have lower premiums but still needs coverage for potential risks.

- Coverage Limits: The amount of coverage a business chooses will directly impact its premium. Higher coverage limits generally lead to higher costs. Small businesses should carefully assess their needs to strike a balance between adequate protection and affordability.

- Claims History: A business’s history of previous claims can significantly affect its premium. Companies that have experienced multiple cyber incidents may face higher rates as insurers perceive them as higher risk.

- Security Measures in Place: Insurers often evaluate the cybersecurity measures a business has implemented when determining premiums. Businesses that invest in robust cybersecurity practices—such as firewalls, encryption, and employee training—may qualify for lower rates due to reduced risk exposure.

Average Cost Range for Small Businesses in Kenya

While specific costs can vary widely, small businesses in Kenya can expect to pay anywhere from KES 30,000 to KES 200,000 annually for cyber insurance premiums, depending on the factors mentioned above. For example:

- A small retail shop with minimal online transactions might pay around KES 30,000 for basic coverage.

- A mid-sized e-commerce business handling sensitive customer data could see premiums rise to KES 100,000 or more, especially if they require extensive coverage.

It’s important for small business owners to shop around and compare quotes from different insurance providers to find the best policy that meets their needs and budget.

Conclusion: Budgeting for Cyber Insurance

Understanding the cost of cyber insurance is crucial for small businesses looking to safeguard themselves against cyber threats. By considering various factors that influence premiums and being aware of average costs, business owners can make informed decisions about their insurance needs. Investing in cyber insurance is not just an expense; it is a strategic move towards protecting their business’s future in an increasingly digital world. This section provides an overview of the costs associated with cyber insurance for small businesses in Kenya, detailing the factors that influence premiums and offering average cost ranges.

Challenges Small Businesses Face in Obtaining Cyber Insurance

While cyber insurance offers significant benefits, small businesses in Kenya often encounter various challenges when trying to obtain coverage. Understanding these obstacles can help business owners navigate the process more effectively and ensure they secure the protection they need. This section will explore common challenges and provide insights on how to overcome them.

Lack of Awareness and Understanding

One of the most significant hurdles small businesses face is a lack of awareness regarding cyber insurance and its importance. Many business owners do not fully understand what cyber insurance entails or how it can protect them from potential risks. This lack of knowledge can lead to hesitancy in pursuing coverage.To address this challenge, small businesses should invest time in educating themselves about cyber insurance. Resources such as industry reports, webinars, and consultations with insurance professionals can provide valuable insights. Additionally, engaging with local business associations or chambers of commerce can help raise awareness about the importance of cybersecurity and insurance.

Navigating the Application Process

The application process for cyber insurance can be complex and intimidating, especially for small business owners who may not have experience with insurance policies. Insurers typically require detailed information about a business’s operations, security measures, and previous claims history. This requirement can be overwhelming for those without a dedicated risk management team.To simplify the application process, small businesses should:

- Prepare Thorough Documentation: Gather relevant information about current cybersecurity measures, employee training programs, and any past incidents. This preparation will help demonstrate to insurers that the business takes cybersecurity seriously.

- Consult with Insurance Brokers: Working with an experienced insurance broker can streamline the process. Brokers can help small businesses understand their options, navigate complex policy language, and find coverage that meets their needs.

Affordability Concerns

Another challenge is the perception that cyber insurance is too expensive for small businesses operating on tight budgets. While premiums can vary significantly based on several factors, many small business owners may overlook the long-term cost savings that come with having coverage.To address affordability concerns:

- Assess Risk vs. Cost: Business owners should evaluate the potential financial impact of a cyber incident compared to the cost of insurance. Understanding that a single data breach could result in losses far exceeding the annual premium may shift perspectives on affordability.

- Explore Multiple Quotes: Small businesses should obtain quotes from various insurers to compare coverage options and pricing. This approach allows them to find a policy that fits their budget while still providing adequate protection.

Conclusion: Overcoming Challenges

While challenges exist in obtaining cyber insurance, small businesses in Kenya can take proactive steps to navigate these obstacles effectively. By increasing awareness, preparing for the application process, and understanding the value of coverage relative to potential losses, business owners can secure essential protection against cyber threats. Ultimately, overcoming these challenges is crucial for ensuring long-term business resilience in an increasingly digital landscape. This section discusses the common challenges small businesses face when seeking cyber insurance and provides actionable strategies for overcoming these obstacles.

How to Choose the Right Cyber Insurance Policy

Selecting the appropriate cyber insurance policy is a critical step for small businesses in Kenya looking to protect themselves from cyber threats. With various options available, it’s essential to understand how to evaluate policies effectively. This section will guide business owners through the process of choosing the right coverage tailored to their specific needs.

Assessing Your Business Needs

Before diving into policy comparisons, small business owners should conduct a thorough assessment of their unique risks and operational requirements. Here are key considerations to keep in mind:

- Identify Specific Risks: Evaluate the types of data your business handles (e.g., customer personal information, payment details) and the potential vulnerabilities in your operations. For instance, a small retail business with an online store may face different risks compared to a local service provider.

- Understand Regulatory Requirements: Familiarize yourself with any legal obligations related to data protection in Kenya, such as the Data Protection Act. Compliance with these regulations can influence the type of coverage needed.

- Determine Coverage Needs: Consider what aspects of cyber incidents you want to be covered. Do you need protection against data breaches, cyber extortion, or business interruption? Identifying your priorities will help narrow down policy options.

Comparing Different Providers

Once you have a clear understanding of your needs, it’s time to compare policies from various insurance providers. Here are some steps to ensure you make an informed choice:

- Research Insurers: Look for reputable insurance companies that specialize in cyber insurance. Check their financial stability and customer reviews to gauge their reliability.

- Request Detailed Quotes: Obtain quotes from multiple insurers and ensure that they include comprehensive details about coverage limits, exclusions, and premium costs. This information will allow for an apples-to-apples comparison.

- Evaluate Policy Terms: Carefully read through the policy terms and conditions. Pay attention to coverage limits, deductibles, and any exclusions that may affect your business in case of a claim.

- Ask Questions: Don’t hesitate to reach out to insurers or brokers with questions about policy specifics or terms you don’t understand. Clarifying these points can prevent misunderstandings later on.

Engaging with Insurance Brokers

Working with an experienced insurance broker can significantly simplify the process of selecting a cyber insurance policy. Brokers can provide valuable insights into the market and help tailor coverage options based on your business needs. Here’s how brokers can assist:

- Expert Guidance: Brokers have expertise in navigating the complexities of cyber insurance and can help identify suitable policies based on your risk profile.

- Negotiation Power: Brokers often have established relationships with insurers, which can lead to better terms and pricing for your coverage.

- Ongoing Support: A good broker will not only help you select a policy but also provide ongoing support throughout the life of the insurance, including assistance during claims processing.

Conclusion: Making an Informed Decision

Choosing the right cyber insurance policy requires careful consideration and thorough research. By assessing specific business needs, comparing different providers, and potentially engaging with an insurance broker, small businesses in Kenya can secure coverage that effectively mitigates risks associated with cyber threats. This proactive approach is essential for ensuring long-term resilience in an increasingly digital world. This section provides guidance on how small businesses can choose the right cyber insurance policy by assessing their needs, comparing providers, and utilizing brokers’ expertise.

Real-Life Examples of Cyber Insurance in Action

Understanding the practical implications of cyber insurance can be greatly enhanced by examining real-life case studies. These examples illustrate how small businesses in Kenya have successfully utilized cyber insurance to mitigate the impact of cyber incidents, recover from breaches, and reinforce their cybersecurity strategies. Here are two compelling case studies that highlight the benefits and effectiveness of cyber insurance.

Case Study 1: A Small Retail Business

Background: A small retail business in Nairobi, which operated both a physical store and an online platform, experienced a significant data breach when hackers gained access to its customer database. The breach exposed sensitive customer information, including names, addresses, and payment details.Incident: The cyberattack occurred during a peak shopping season, leading to immediate concerns about customer trust and financial losses. The business faced potential lawsuits from affected customers and regulatory scrutiny for failing to protect sensitive data.Response: Fortunately, the retail business had invested in a comprehensive cyber insurance policy that included both first-party and third-party coverage. This policy provided:

- Data Restoration Costs: The insurance covered the expenses associated with forensic investigations to determine the breach’s scope and restore compromised data.

- Business Interruption Losses: The policy compensated for lost revenue during the downtime caused by the incident, allowing the business to maintain financial stability.

- Legal Defense Costs: The insurance covered legal fees associated with defending against lawsuits filed by affected customers.

Outcome: With the support of their cyber insurance policy, the retail business was able to recover quickly from the incident. They restored their systems within a week and launched a customer notification campaign to inform affected individuals. As a result, they managed to rebuild customer trust and resumed operations with improved cybersecurity measures in place.

Case Study 2: A Local Service Provider

Background: A small IT service provider based in Mombasa experienced a ransomware attack that encrypted critical business files and demanded a ransom payment for decryption keys. The attack not only disrupted operations but also threatened client projects and deadlines.Incident: Faced with the prospect of losing access to vital data, the service provider needed to act quickly. They had previously recognized their vulnerability and secured a cyber insurance policy that included coverage for ransomware attacks.Response: Thanks to their cyber insurance policy, the service provider received immediate support in several areas:

- Cyber Extortion Coverage: The policy covered the ransom payment demanded by cybercriminals, allowing the business to regain access to its files without incurring significant out-of-pocket costs.

- Incident Response Services: The insurer provided access to cybersecurity experts who helped assess the attack’s impact, implement security measures to prevent future incidents, and develop an incident response plan.

- Legal Assistance: The policy also included legal support to navigate compliance issues related to data protection laws following the attack.

Outcome: With the assistance of their cyber insurance policy, the service provider was able to recover from the ransomware attack without crippling financial losses. They implemented stronger cybersecurity protocols as recommended by their insurer and regained client confidence by demonstrating their commitment to protecting sensitive information.

Conclusion: Learning from Real-Life Experiences

These case studies illustrate how small businesses in Kenya can benefit significantly from having cyber insurance in place. By providing financial protection, legal support, and access to expert resources, cyber insurance enables businesses to respond effectively to cyber incidents. As cyber threats continue to evolve, investing in such coverage becomes increasingly essential for ensuring long-term resilience and success in a digital world. This section presents real-life examples of how small businesses in Kenya have successfully utilized cyber insurance during cyber incidents. These case studies highlight the practical benefits of having coverage in place.

The Future of Cyber Insurance for Small Businesses in Kenya

As the digital landscape continues to evolve, so too does the importance of cyber insurance for small businesses in Kenya. With increasing reliance on technology and growing cyber threats, the future of cyber insurance is poised for significant transformation. This section will explore emerging trends, the role of technology in enhancing cybersecurity, and what small businesses can expect in the coming years.

Trends in the Cyber Insurance Market

- Increased Demand for Coverage: As awareness of cyber threats grows, more small businesses are recognizing the need for cyber insurance. The demand for coverage is expected to rise sharply, especially as regulatory requirements become more stringent. Businesses that previously overlooked cyber insurance are now seeking policies to protect themselves from potential financial losses.

- Tailored Policies for Small Businesses: Insurers are increasingly offering tailored policies specifically designed for small businesses. These policies take into account the unique risks faced by smaller enterprises and provide more relevant coverage options at competitive prices. This trend will make it easier for small businesses to find suitable insurance solutions.

- Integration of Cybersecurity Services: Many insurers are beginning to bundle cybersecurity services with their insurance policies. This integration may include risk assessments, employee training programs, and incident response planning, providing small businesses with not just financial protection but also practical resources to enhance their cybersecurity posture.

- Data-Driven Underwriting: The use of data analytics in underwriting is becoming more prevalent in the cyber insurance market. Insurers are leveraging data to assess risk more accurately, which can lead to more personalized premiums based on a business’s specific cybersecurity measures and claims history.

The Role of Technology in Enhancing Cybersecurity

Technology plays a crucial role in shaping the future of cyber insurance and enhancing overall cybersecurity for small businesses:

- Advanced Threat Detection: Innovations in artificial intelligence (AI) and machine learning are enabling businesses to detect and respond to threats more effectively. These technologies can analyze patterns and identify anomalies that may indicate a cyber threat, allowing businesses to take proactive measures before an incident occurs.

- Cloud-Based Solutions: Many small businesses are migrating to cloud-based solutions that offer enhanced security features. These solutions often include built-in protections against data breaches and ransomware attacks, reducing overall risk exposure.

- Cybersecurity Training Tools: As human error remains a leading cause of security breaches, technology-driven training tools are becoming essential. Interactive training programs can help employees recognize phishing attempts and other cyber threats, fostering a culture of cybersecurity awareness within organizations.

What Small Businesses Can Expect

As the cyber insurance landscape evolves, small businesses in Kenya should prepare for several key developments:

- Greater Accessibility: With increased competition among insurers and a growing recognition of the importance of cybersecurity, small businesses can expect more accessible and affordable cyber insurance options.

- Emphasis on Risk Management: Insurers will likely place greater emphasis on risk management practices when underwriting policies. Small businesses that demonstrate strong cybersecurity measures may benefit from lower premiums and better coverage terms.

- Ongoing Education and Support: The relationship between insurers and policyholders is expected to become more collaborative. Insurers will increasingly offer ongoing education and support to help small businesses stay informed about emerging threats and best practices for cybersecurity.

Conclusion: Preparing for the Future

The future of cyber insurance for small businesses in Kenya looks promising as awareness grows and coverage options expand. By staying informed about emerging trends and leveraging technology to enhance their cybersecurity posture, small business owners can position themselves effectively in an increasingly digital world. Investing in cyber insurance not only provides financial protection but also fosters resilience against evolving cyber threats. This section discusses the future of cyber insurance for small businesses in Kenya, highlighting emerging trends, technological advancements, and what business owners can expect moving forward.

Cybercrime, Online Breaches, And Threats in Kenya: Cyber Insurance, The Cover You Didn’t Know You Needed - Step By Step Insurance

April 30, 2025 @ 8:45 am

[…] Cyber insurance, also known as cyber liability insurance, is an essential risk management tool that provides coverage against the fallout of cyberattacks and digital threats. Yet, many Kenyan entrepreneurs and executives are unaware of its existence or importance. That’s why the Step By Step Insurance Agency is taking the lead in educating and equipping businesses with expert advice and customized cyber insurance solutions to help them stay secure in a connected world. […]