Understanding Health Insurance in Kenya: The 4 Most Common Health Insurance Plans in Kenya

Health insurance is becoming increasingly essential in Kenya as individuals and families seek financial protection against rising medical costs. While public healthcare services are available, private health insurance plans offer enhanced coverage, faster access to healthcare providers, and specialized services that cater to diverse needs. With a growing number of insurers entering the market, understanding the most common types of medical insurance in Kenya can help you make an informed decision.

Key Takeaways

- There are four major types of health insurance plans in Kenya: Individual/Family, Employer-Based, Senior Citizen, and Micro Health Insurance plans.

- Individual and Family plans offer comprehensive coverage with options for inpatient, outpatient, and maternity benefits.

- Employer-Based plans provide affordable group coverage for company employees.

- Senior Citizen plans offer specialized coverage for individuals over 60 years old.

- Micro Health Insurance makes basic healthcare accessible to low-income populations.

Table of Contents

In this article, we’ll explore the four most common health insurance plans in Kenya, detailing their features, benefits, and examples from leading providers.

Individual and Family Medical Insurance Plans

Individual and family medical insurance plans are among the most popular options in Kenya. These plans are tailored to provide comprehensive coverage for individuals or entire families, ensuring access to quality healthcare without financial strain.

What They Cover

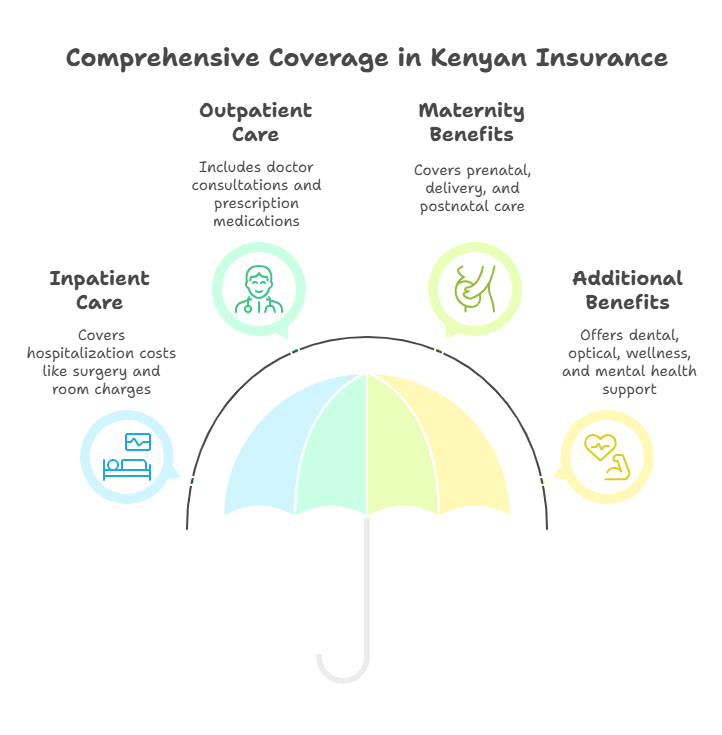

Individual and family medical insurance plans typically include:

- Inpatient Care: Covers hospitalization costs such as surgery, room charges, and intensive care.

- Outpatient Care: Includes doctor consultations, diagnostic tests, and prescription medications.

- Maternity Benefits: Covers prenatal care, delivery costs, and postnatal care.

- Additional Benefits: Some plans also offer dental, optical, wellness check-ups, and mental health support.

Who They’re For

These plans are ideal for individuals who want personalized coverage or families seeking comprehensive protection for all members. For instance, a family with young children may benefit from the inclusion of pediatric care and vaccinations.

Examples of Providers

Several insurers offer individual and family medical insurance plans in Kenya:

- AAR Insurance: Provides packages like Cover Me (Bronze, Silver, Gold, Platinum), tailored for different budgets.

- Jubilee Insurance: Offers J-Care plans with extensive inpatient and outpatient benefits.

- Britam Insurance: Features the Milele Health Plan with flexible options for families.

- Old Mutual Insurance: Afya Imara packages cater to both individuals and families with varying coverage limits.

Looking for affordable options? Check out our guide on The Best Most Affordable Medical Insurance in Kenya 2025 for budget-friendly solutions without compromising on quality.

Cost Considerations

Premiums vary depending on factors such as age, number of dependents, and coverage level. For example:

| Provider | Approximate Annual Premium (KES) | Coverage Limit (KES) |

|---|---|---|

| AAR Bronze Plan | 25,000 | Up to 1M (inpatient) |

| Jubilee J-Care | 30,000 | Up to 2M (inpatient) |

| APA Afya Nafuu | 20,000 | Up to 750K (inpatient) |

Employer-Based Medical Insurance Plans

Employer-based medical insurance plans are provided by companies as part of employee benefits packages. These plans aim to ensure employees have access to quality healthcare while reducing their financial burden.

What They Cover

Coverage under employer-based plans often includes:

- Inpatient care for hospitalization needs.

- Outpatient care such as consultations and medications.

- Maternity benefits for employees or their spouses.

- Additional services like dental care or wellness programs (depending on the employer).

Who They’re For

These plans are designed for employees working in organizations that prioritize staff welfare. Employers often negotiate group rates with insurers to provide affordable yet comprehensive coverage.

Examples of Providers

Many companies partner with leading insurers like Jubilee Health Insurance or Britam to offer employer-sponsored health insurance packages that align with corporate budgets.

Wondering how employer-provided health insurance compares to government options? Read our comparison of SHIF vs Private Health Insurance in Kenya 2025 to understand which option might be better for your situation.

Benefits of Employer-Based Plans

- More affordable premiums due to group rates.

- Boosts employee satisfaction and productivity by reducing financial stress related to healthcare costs.

Senior Citizen Medical Insurance Plans

Senior citizen medical insurance plans cater specifically to older individuals who may require specialized healthcare services due to age-related conditions.

What They Cover

These plans typically include:

- Comprehensive inpatient care for chronic illnesses or surgeries.

- Outpatient services such as regular check-ups and diagnostic tests.

- Coverage for pre-existing conditions like diabetes or hypertension.

Who They’re For

Senior citizens aged 60 years or older who need tailored healthcare solutions can benefit significantly from these plans.

Examples of Providers

Some insurers offering senior citizen health insurance include:

- Old Mutual Afya Imara Seniors Plan: Provides coverage ranging from Ksh 500K to Ksh 10M with outpatient limits up to Ksh 200K.

- GA Insurance Hadhi Health Plan: Offers dignified homecare services alongside inpatient and outpatient coverage.

Unique Features of Senior Plans

Senior health insurance often includes additional benefits like pain management coverage, emergency evacuation services (e.g., air evacuations), and homecare provided by trained personnel.

For a more in-depth look at leading providers in the Kenyan market, explore our guide to Top Providers in Medical Insurance in Kenya and what makes each one stand out.

Micro Health Insurance Plans

Micro health insurance plans are designed to provide affordable healthcare coverage for low-income individuals and families who may otherwise struggle to access private health insurance.

What They Cover

Micro health insurance typically offers basic healthcare services such as:

- Inpatient care for hospital stays and surgeries.

- Outpatient consultations and treatments.

- Maternity benefits including prenatal care and delivery costs.

Who They’re For

These plans target underserved populations who lack access to traditional health insurance due to cost barriers.

Examples of Providers

One notable micro health insurance plan is Linda Jamii by Safaricom, Britam, and Changamka Micro-insurance. It offers coverage worth Ksh 290K at an annual premium of Ksh 12K.

Looking for budget-friendly options? We offer Medical Insurance Starting From Kshs 12,000 Per Year that provides essential coverage without breaking the bank.

Why Choose Micro Health Insurance?

Microinsurance promotes inclusion by offering flexible payment options through platforms like M-Pesa, allowing policyholders to pay premiums in installments.

Factors to Consider When Choosing a Health Insurance Plan

When selecting a health insurance plan in Kenya, consider the following factors:

- Coverage Needs: Assess whether you need inpatient care only or additional outpatient services like dental or optical care.

- Budget: Compare premiums across providers to find a plan that fits your financial situation without compromising on essential benefits.

- Provider Network: Ensure the insurer has partnerships with hospitals near you for convenience during emergencies or routine visits.

- Policy Exclusions: Carefully read the terms to understand what is not covered under your policy (e.g., certain pre-existing conditions).

- Waiting Periods: Check how long you must wait before accessing specific benefits like maternity cover or chronic illness treatment.

Conclusion

Kenya’s private health insurance landscape offers diverse options tailored to meet various needs—from individual plans for families seeking comprehensive protection to microinsurance targeting underserved populations. By understanding the features and benefits of these common types of medical insurance in Kenya—individual/family plans, employer-based packages, senior citizen covers, and microinsurance—you can make informed decisions about your healthcare future.

Take time to compare providers like AAR Insurance, Jubilee Health Insurance, Britam Milele Health Plan, APA Insurance Jamii Plus Cover, and others before choosing a plan that aligns with your needs and budget.

For more information on how health insurance works in Kenya or assistance selecting a plan that suits you best, visit Step by Step Insurance.