Farm Protector Insurance in Kenya – A Complete Guide for Agribusiness Owners

Agribusiness in Kenya is rewarding, but it’s also unpredictable. One bad season, an equipment breakdown, or unexpected disaster can cause massive losses. That’s why Farm Protector Insurance exists — to safeguard your farm or agricultural business from risks that could disrupt your operations. The Geminia Farm Protector package is designed to provide comprehensive, customizable protection for every stage of the agricultural value chain — from production to processing, distribution, and even sales.

Key Takeaways

- Farm Protector Insurance offers 12 comprehensive coverage sections for complete agricultural protection

- Customizable coverage allows you to select only the sections relevant to your specific farming needs

- Coverage spans the entire agricultural value chain from production to sales

- One simplified policy replaces multiple separate insurance policies

- Suitable for small-scale farmers to large agribusiness companies

Table of Contents

🌾 Join Our Insurance Community!

Connect with fellow farmers and agribusiness owners. Get the latest insurance trends, tips, and exclusive updates delivered directly to your phone.

📱 Join WhatsApp GroupWhat is Farm Protector Insurance?

Farm Protector Insurance is a sectionalized insurance package that covers a wide range of risks in agriculture, from crops and livestock to buildings, machinery, employees, and even your income. Instead of buying multiple separate policies, you can select the sections relevant to your business and get them all under one simplified policy.

Key Areas Covered Under Farm Protector Insurance

Farm Protector is divided into 12 main sections, each covering specific risks. You can choose the ones that apply to your farm or agribusiness.

| Coverage Section | Description | Key Benefits |

|---|---|---|

| Agriculture Insurance | Protects biological assets such as livestock, crops, and plants — including those under contract farming, leasing, or financing agreements. | Comprehensive biological asset protection |

| Buildings, Structures & Equipment | Covers damage or loss to farm buildings, greenhouses, fittings, and fixtures due to fire or other listed risks. | Property and infrastructure security |

| Work Injury Benefit Act (WIBA) | Provides compensation to employees injured while on the job — meeting your legal obligations. | Legal compliance and employee protection |

| Greenhouse Insurance | Protects the greenhouse structure and crops inside against windstorms, excessive rainfall, and fire. | Specialized greenhouse protection |

| Machinery Breakdown | Covers damage to essential farm and processing machinery due to sudden and unforeseen breakdowns. | Equipment continuity assurance |

| Burglary | Protects against theft involving forcible entry into your premises. | Security against theft |

| Goods in Transit | Covers goods being transported — from your farm to the market or processing facility. | Transportation risk coverage |

| Office Equipment | Protects your office tools and electronics from sudden loss or damage. | Administrative asset protection |

| Farm Motor Vehicles | Covers tractors, harvesters, farm trailers, and other agricultural vehicles. | Agricultural vehicle protection |

| Deterioration of Stock | Compensates for perishable goods (like fish, milk, or produce) that spoil due to cold storage equipment failure. | Perishable goods security |

| Loss of Profit | Covers lost income if production stops due to the loss of crops or livestock. | Income protection guarantee |

| Credit Life | Ensures debt repayments are covered if a borrower in your agribusiness passes away. | Debt protection for families |

Extra Cover Options

You can also add these additional protections to enhance your coverage:

Who Can Apply?

This comprehensive coverage is ideal for various agricultural stakeholders:

🌱 Small to Large-Scale Farmers

Whether you’re growing maize, vegetables, or managing livestock, protect your livelihood with customized coverage options.

🏢 Agribusiness Companies

Comprehensive protection for commercial agricultural operations from seed to market.

🚛 Produce Distributors

Secure your goods in transit and protect your distribution infrastructure.

🏭 Food Processors

Cover your processing equipment, facilities, and finished products against unexpected losses.

🏪 Agri-Retailers

Protect your inventory, premises, and business operations in the agricultural retail sector.

Why Choose Farm Protector Insurance?

For farmers looking to understand more about specialized agricultural coverage, you can also explore our comprehensive guide on crop insurance in Kenya, which provides detailed insights into current trends and solutions.

How Claims Are Settled

Claims are processed efficiently and paid based on the following criteria:

🌾 Crop Damage Claims

Compensation based on verified damage to insured crops due to covered perils like weather, disease, or pests.

🐄 Livestock Death Claims

Payment for death of insured livestock due to accident, disease, or other covered causes.

🏗️ Property Destruction Claims

Coverage for destruction or loss of insured buildings, equipment, and other property assets.

📋 Other Covered Claims

All other claims are settled according to the declared values specified in your individual policy terms.

Ready to Protect Your Farm? Contact Us Today!

Get personalized advice and quotes for your specific agricultural needs.

📞 Call Us

+254 (0) 729 712 200

+254 (0) 716 534 192

0722 888 350

🌐 Online

Get Your Farm Protector Insurance Quote Today!

Protect your agricultural investment with comprehensive, customizable coverage.

Get Free Quote NowFinal Thoughts

Farming is a business, and like any business, it needs protection. With the Geminia Farm Protector, you can secure your crops, animals, equipment, employees, and even your profits under one easy-to-manage policy. Don’t let unexpected risks destroy years of hard work – invest in comprehensive agricultural insurance that grows with your business.

The agricultural sector in Kenya faces numerous challenges, from unpredictable weather patterns to market volatility. Farm Protector Insurance provides the peace of mind you need to focus on what you do best – growing your agricultural business. Whether you’re a small-scale farmer or managing a large agribusiness operation, this comprehensive insurance solution adapts to your specific needs and budget.

Take the first step towards securing your agricultural future. Contact our experienced agricultural insurance specialists today to discuss how Farm Protector Insurance can be tailored to your unique farming operation. Your farm’s protection is our priority.

Revolutionizing Agricultural Insurance in Kenya: How Ripple’s Blockchain Pilot Empowered Pastoralists in Laikipia

In Kenya’s arid and semi-arid landscapes, drought isn’t just a weather condition—it’s a recurring crisis. For pastoralist communities in places like Laikipia County, it’s a slow and brutal erosion of livelihoods, hope, and even identity. Livestock deaths, crop failure, and market instability ripple through families with terrifying speed, leaving little time to recover before the next dry spell.

Key Takeaways

- Automated relief: Blockchain technology enables instant payouts when drought conditions are detected

- Transparency: Smart contracts eliminate bureaucracy and build trust through verifiable transactions

- Pastoralist empowerment: Financial support arrives in 48 hours instead of weeks or months

- Scalable solution: The model can be replicated across drought-prone regions in Africa and beyond

- Dignity preserved: Timely assistance prevents distress sales of assets and maintains livelihoods

Table of Contents

- Context and Background: The Anatomy of a Crisis

- Inside Ripple’s Pilot Program: Tech That Talks to the Sky

- Impact on Pastoral Communities: More Than Just Money

- Innovations in Insurance Delivery: A Paradigm Shift

- Broader Implications and Scalability: Ripple Effects Across Africa

- Conclusion: Tradition Meets Innovation in the Climate Battle

Join Our Insurance Insights Community

Connect with experts and stay updated on the latest insurance innovations, trends, and opportunities in Kenya and across Africa. Share experiences and get your questions answered in real-time.

Join WhatsApp Group NowBut what if relief didn’t have to wait for government aid, NGO interventions, or lengthy insurance claims? What if payouts could be automatic, transparent, and triggered by satellite data rather than paperwork? That’s the vision Ripple brought to life with its drought insurance pilot program, harnessing the power of blockchain and smart contracts to reshape the future of agricultural risk management.

Let’s explore how this technological leap unfolded in Laikipia—and why it might just rewrite the playbook on climate resilience.

II. Context and Background: The Anatomy of a Crisis

Laikipia’s Vulnerability

Laikipia is home to thousands of pastoralist families who rely almost entirely on livestock for income, food, and social status. The county has endured repeated droughts, many of which have escalated into humanitarian emergencies. With minimal irrigation infrastructure and limited access to traditional insurance, pastoralists remain at the mercy of nature’s volatility.

Why Insurance Has Historically Fallen Short

Conventional agricultural insurance models often demand:

- Field verification of losses

- Formal documentation and receipts

- Waiting periods for assessments and approval

These requirements make insurance inaccessible for the very communities that need it most. Informal economies don’t generate receipts, and verifying losses can take weeks—especially in remote areas.

Enter Blockchain and Smart Contracts

Blockchain—a decentralized digital ledger—offers security, transparency, and automation. Smart contracts are self-executing agreements coded to trigger actions when certain conditions are met. For drought insurance, those conditions could be rainfall thresholds, satellite heat readings, or vegetation indices. No more delays. No more middlemen. Just instant relief when nature deals a cruel hand.

III. Inside Ripple’s Pilot Program: Tech That Talks to the Sky

Ripple’s Laikipia pilot was designed not just to innovate—but to solve real, on-the-ground problems. Here’s how it was structured:

Objectives

The goal was simple yet radical:

- Provide timely financial relief after drought events

- Use automated payout mechanisms driven by smart contracts

- Build trust through transparency and data integrity

Scope and Scale

The pilot ran for six months during Kenya’s long dry season, targeting over 1,000 pastoralists across four wards. Participants were enrolled through local cooperatives, which served as both outreach partners and feedback conduits.

Technology Stack

The system integrated:

- Satellite Data: Tracking rainfall, vegetation health, and ground moisture

- Smart Contracts: Written to initiate payouts once drought criteria were met

- Mobile Wallets: Enabling beneficiaries to receive funds directly on their phones

It wasn’t just blockchain for the sake of buzzwords. The tech was tailored for impact—bringing financial security to the fingertips of farmers hundreds of kilometers from urban centers.

IV. Impact on Pastoral Communities: More Than Just Money

Speed and Transparency

When rainfall dipped below the trigger threshold for 30 consecutive days, the system sprang to life. Funds hit mobile wallets within 48 hours—no forms to fill, no questions asked. This immediacy allowed families to:

- Purchase supplemental feed

- Transport animals to safer grazing grounds

- Offset income losses without borrowing or selling assets

Human Stories

Fatuma, a pastoralist in Rumuruti, shared:

“Before, we waited weeks and sometimes got nothing. Now, I see the drought coming and know something will come to help me. That makes me sleep easier.”

These stories were echoed across focus groups—participants felt empowered and supported, not dependent.

Psychological Uplift

The relief wasn’t just financial. It restored dignity. Knowing that someone—or something—is watching the skies on your behalf and will act automatically builds a sense of control and resilience.

| Article | Link |

|---|---|

| Crop Insurance for Smallholder Farmers in Kenya | Read Article |

| Protecting Kenya’s Informal Sector with Index-Based Insurance | Read Article |

| World Bank Disburses Sh1.4 Billion in Livestock Insurance | Read Article |

| Top 5 Farm Insurance Companies in Kenya | Read Article |

V. Innovations in Insurance Delivery: A Paradigm Shift

Let’s be real: traditional insurance can feel like a labyrinth. Ripple’s model bulldozed those barriers.

From Trust Deficit to Trust Dividend

Insurance uptake in Kenya has historically been low, partly due to mistrust. Many view insurers as slow to act and quick to deny claims. Blockchain flips the narrative:

- All transactions are visible on the ledger

- Payout logic is coded—no room for bias or manipulation

- Users can verify terms and conditions themselves

When transparency becomes a feature—not a promise—trust follows.

Real-Time Response vs Bureaucracy

By leveraging real-time satellite inputs, the program sidestepped the bottlenecks of field assessments. Imagine this: while a conventional insurer deploys a team to count dead livestock, a smart contract disburses funds based on drought data verified by multiple satellite nodes. Efficiency meets empathy.

VI. Broader Implications and Scalability: Ripple Effects Across Africa

Replicability Potential

Kenya isn’t the only country grappling with erratic climate patterns. Ripple’s model is scalable to:

- The Sahel region, where desertification threatens livelihoods

- Southern Africa, which is seeing increasingly unpredictable rain cycles

- Southeast Asia, for rice farmers impacted by monsoonal shifts

The common denominator? Communities in need of fast, fair, and tech-driven insurance solutions.

Role of Partnerships

Ripple didn’t go it alone. Its success hinged on:

- Local cooperatives for mobilization and trust-building

- Satellite providers for climate data

- Mobile operators for wallet integration

- Regulatory bodies for oversight and legal clarity

This mosaic of collaboration illustrates how public-private partnerships are crucial in scaling fintech for good.

Regulatory Evolution

As models like Ripple’s gain traction, regulators must adapt:

- Define legal status of smart contracts

- Ensure data privacy and protection

- Create sandboxes for pilot testing

Kenya’s forward-thinking Insurance Regulatory Authority (IRA) has already begun exploring frameworks to accommodate parametric and blockchain-based insurance products.

VII. Conclusion: Tradition Meets Innovation in the Climate Battle

In a world tilting ever more toward climate volatility, traditional solutions won’t cut it. Ripple’s drought insurance pilot in Laikipia wasn’t just a test—it was a tectonic shift in how we think about risk, relief, and resilience.

It showed that pastoralists don’t need to be passive victims of weather patterns. With the right tools—ones built on transparency, automation, and empathy—they can prepare, respond, and rebuild faster than ever before.

This pilot didn’t just deliver payouts; it delivered dignity. And in doing so, it created a roadmap for other regions, sectors, and innovators who believe that tech should serve not just the powerful, but the vulnerable too.

Further Reading

- Crop Insurance for Smallholder Farmers in Kenya: Eligibility, Benefits, and How to Apply

- Securing Kenya’s Economic Backbone: How Index-Based Insurance Protects the Informal Sector

- World Bank Disburses Sh1.4 Billion in Livestock Insurance Payments to Kenyan Farmers

- Top 5 Best Farm Insurance Companies in Kenya: Find the Right Coverage for Your Needs

Get Expert Insurance Guidance

Have questions about agricultural insurance? Need help finding the right coverage for your farm or livestock? Our insurance specialists are ready to assist you.

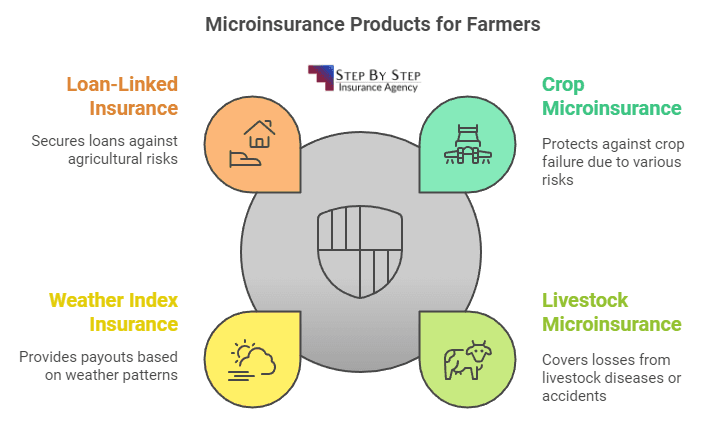

Microinsurance Products Available for Farmers in Kenya

Microinsurance is a vital tool for smallholder farmers in Kenya, offering them a safety net against the unpredictable risks associated with agriculture. With agriculture and livestock contributing significantly to Kenya’s economy—accounting for about one-third of its annual output—farmers face increasing challenges due to climate change, market fluctuations, and natural disasters. Microinsurance products are designed to be affordable and accessible, providing essential coverage for farmers who often operate on tight budgets.

In this article, we will explore the various microinsurance products available for farmers in Kenya, their benefits, challenges, and how they can enhance financial security and resilience in the agricultural sector.

What is Microinsurance?

Definition of Microinsurance

Microinsurance refers to insurance products specifically designed to be affordable for low-income individuals or groups, particularly those who are often excluded from traditional insurance markets. Unlike conventional insurance, which may require high premiums and complex policies, microinsurance aims to provide simple, low-cost coverage that meets the unique needs of smallholder farmers.

Importance of Microinsurance for Farmers

Microinsurance plays a crucial role in enhancing financial security for farmers. It allows them to manage risks effectively and encourages them to invest in better agricultural practices and inputs. By mitigating the financial impact of crop failures or livestock losses, microinsurance helps stabilize farmers’ incomes and promotes sustainable agricultural practices.

Types of Microinsurance Products Available for Farmers in Kenya

1. Crop Microinsurance

Crop microinsurance is tailored to protect farmers against losses due to adverse weather conditions, pests, and diseases. Notable products include:

- Kilimo Salama: This program offers weather-indexed crop insurance that compensates farmers based on rainfall data rather than actual crop damage assessments. By using automated weather stations and mobile technology, Kilimo Salama has insured over 187,000 farmers since its inception.

- Bima Pima: Translated as “insurance in affordable bits,” Bima Pima allows farmers to purchase scratch cards that provide insurance coverage when they buy seeds or fertilizers. The initial premium can be as low as KES 50 (approximately $0.50), making it accessible for many smallholders.

2. Livestock Microinsurance

Livestock microinsurance protects farmers from losses related to their animals due to diseases or accidents. Key offerings include:

- Dairy Livestock Insurance: This product is designed for dairy farmers who supply milk to cooperatives. It covers losses due to illness or death of high-yield cows and is often bundled with veterinary services

. - Loan-Linked Insurance: This type of insurance is linked to loans taken by farmers for purchasing livestock. It ensures that if the farmer suffers a loss, the insurance covers the loan repayment, thus protecting both the farmer and the lending institution.

3. Weather Index Insurance

Weather index insurance is an innovative product that provides payouts based on specific weather conditions rather than actual losses. This type of insurance is particularly beneficial in areas prone to drought or excessive rainfall. Farmers receive compensation based on data collected from weather stations or satellite imagery. This approach reduces the need for costly loss verification processes.

4. Loan-Linked Insurance

Loan-linked insurance products are designed specifically for smallholders who have taken out loans for agricultural inputs. These products ensure that if a farmer suffers a loss due to adverse conditions, the insurance compensates them enough to cover their loan obligations.

Key Providers of Microinsurance in Kenya

a. ACRE Africa

ACRE Africa is one of the largest micro-insurance providers in Africa and plays a significant role in offering tailored solutions for Kenyan farmers. Their innovative approach includes using satellite data and mobile technology to assess risks and provide timely payouts.

b. Kilimo Salama

Kilimo Salama has been a pioneer in providing accessible crop insurance through its unique model that combines technology with traditional farming practices. By eliminating on-site inspections through automated weather data collection, Kilimo Salama has made it possible for more farmers to access insurance.

c. Pula Advisors

Pula Advisors focuses on bundling agricultural inputs with insurance products. They work closely with seed companies and other suppliers to offer free insurance coverage as part of their product offerings. This model not only protects farmers but also encourages them to invest in quality seeds and fertilizers.

Benefits of Microinsurance for Farmers

Microinsurance provides numerous advantages that can significantly impact smallholder farmers:

1. Financial Protection

Microinsurance acts as a safety net against unexpected losses. By providing compensation during adverse conditions, it helps stabilize farmers’ incomes and reduces vulnerability.

2. Increased Investment in Agriculture

With the assurance that they will be compensated for losses, farmers are more likely to invest in high-quality seeds, fertilizers, and modern farming techniques. This investment can lead to increased productivity and better yields.

3. Improved Food Security

By protecting farmers’ livelihoods, microinsurance contributes to overall food security within communities. When farmers can sustain their production levels despite challenges, it ensures a steady supply of food.

Challenges Facing Microinsurance Uptake in Kenya

Despite its benefits, several challenges hinder the widespread adoption of microinsurance among Kenyan farmers:

1. Awareness and Education

Many farmers are unaware of available microinsurance products or do not understand how they work. Education initiatives are crucial for increasing uptake.

2. Affordability Concerns

While microinsurance is designed to be affordable, some farmers still find it challenging to pay premiums due to their limited income.

3. Accessibility Issues

Geographic barriers can limit access to microinsurance products. Farmers in remote areas may struggle to find providers or may not have access to mobile technology necessary for purchasing policies.

How to Access Microinsurance Products in Kenya

Farmers interested in accessing microinsurance products can follow these steps:

- Research Available Products: Start by researching different microinsurance options that suit your farming needs.

- Contact Local Providers: Reach out to local agribusinesses or cooperatives that offer microinsurance.

- Complete Necessary Documentation: Fill out any required forms and provide necessary information about your farm.

- Pay Premiums: Make sure you understand the premium payment process—many providers allow payments through mobile money platforms.

Case Studies: Success Stories from Kenyan Farmers

Example 1: Jacob Wambua’s Dairy Farm Success

Jacob Wambua is a successful dairy farmer who has benefited significantly from taking up livestock microinsurance. Operating in Machakos County—a region prone to drought—Wambua faced numerous challenges due to climate variability. However, by enrolling in an insurance program offered through his cooperative, he was compensated when he lost cows due to disease. This financial support allowed him not only to recover but also expand his herd size and increase milk production.

“Insurance has given me peace of mind,” says Wambua. “I know I can invest confidently knowing I have protection against unforeseen events.”

Example 2: Impact of Bima Pima on Smallholder Farmers

Farmers using Bima Pima have reported substantial improvements in their farming outcomes. For instance, Mary Mate from Embu County shared her experience after receiving compensation through her Bima Pima policy when drought affected her crops. The quick payout allowed her to replant immediately, resulting in a successful harvest later that season.

Conclusion

Microinsurance products available for farmers in Kenya represent a transformative solution aimed at enhancing resilience against climate change and financial instability. By providing affordable coverage tailored specifically for smallholder needs, these products empower farmers like Jacob Wambua and Mary Mate to manage risks effectively while investing confidently in their agricultural practices.

As awareness grows around these innovative solutions, it is crucial for stakeholders—including government agencies, NGOs, and private sector players—to collaborate further in promoting microinsurance uptake among Kenyan farmers.

Top 5 Best Farm Insurance Companies in Kenya: Find the Right Coverage for Your Needs

Kenya’s agricultural sector is a major pillar of the economy, contributing nearly 33% of the country’s GDP and employing over 40% of the population. With agriculture playing such a crucial role in Kenya’s economy, farmers face numerous risks, from unpredictable weather patterns and natural disasters to disease outbreaks and market fluctuations. This is where farm insurance comes into play.

Farm insurance provides essential protection for farmers, covering a range of risks that could otherwise lead to significant financial losses. Whether you’re growing crops, raising livestock, or managing a large-scale agribusiness, securing the right farm insurance ensures that your investment is protected from unforeseen disasters like drought, pest invasions, and theft.

In this guide, we’ll explore the top 5 best farm insurance companies in Kenya and help you find the best coverage for your specific needs. From coverage options to costs and customer satisfaction, we’ll break down everything you need to know to make an informed decision.

Let’s start by understanding the basics of farm insurance and why it’s so important for Kenyan farmers.

What is Farm Insurance? (Understanding Farm Insurance in Kenya)

Farm insurance is a specialized insurance product designed to protect farmers from the financial impact of unforeseen risks and disasters. In Kenya, farm insurance typically covers crop failures, livestock losses, farm equipment damage, and other agricultural-related losses.

Key Types of Farm Insurance Available in Kenya

Farmers in Kenya can choose from several types of farm insurance, depending on the size of their farm, type of agricultural activity, and risk exposure. Here are the most common types of farm insurance available in the country:

- Crop Insurance: Protects farmers from losses due to drought, floods, pest attacks, and diseases. Coverage is often based on the expected yield and market prices of the crops.

- Livestock Insurance: Covers losses from the death of animals due to diseases, accidents, or natural disasters. This is critical for farmers who rely on livestock such as cattle, goats, sheep, and poultry.

- Farm Equipment Insurance: Protects against damage or loss of farm machinery such as tractors, plows, and irrigation systems due to theft, fire, or mechanical breakdowns.

- Greenhouse Insurance: Special coverage for farmers using greenhouses to protect their crops from extreme weather, pests, or diseases.

- Comprehensive Farm Insurance: A combination of the above, offering broader coverage that protects both crops and livestock, as well as equipment and other farm infrastructure.

Why Do Farmers Need Farm Insurance in Kenya?

Kenya’s agricultural sector faces unique challenges due to the country’s reliance on rain-fed agriculture, which makes farmers highly vulnerable to climate variability. With drought being a recurring issue, many farmers experience total crop failure, leading to severe economic losses. Farm insurance provides a safety net, helping farmers recover from these losses and continue their operations without falling into debt.

For example: In 2017, over 1.3 million Kenyans were affected by severe droughts that decimated crops and livestock. Without farm insurance, many smallholder farmers faced financial ruin.

Other risks include:

- Pest and Disease Outbreaks: The locust invasion of 2020 severely impacted several counties in Kenya, destroying crops across thousands of hectares.

- Natural Disasters: Heavy rains and flooding during the rainy seasons can lead to crop and livestock losses, as well as the destruction of farm infrastructure.

- Theft and Vandalism: Theft of livestock and farm equipment is a common issue, especially in rural areas.

How Does Farm Insurance Work?

Farm insurance policies in Kenya are offered by several insurance companies and can be tailored to suit the specific needs of a farmer. Here’s a general outline of how the process works:

- Purchasing a Policy: Farmers select an insurance provider and choose a plan based on the specific risks they face. For instance, a maize farmer in the arid regions may prioritize drought coverage, while a dairy farmer may need livestock protection.

- Paying Premiums: The cost of the policy is known as a premium, which is paid annually or semi-annually. The amount of the premium depends on factors like farm size, crop/livestock type, and geographic location.

- Filing Claims: In the event of a loss, such as crop failure due to drought or livestock loss due to disease, the farmer can file a claim with the insurance provider. The insurance company will then assess the damage and pay out compensation based on the policy terms.

The Importance of Farm Insurance in Building Resilience

Farm insurance doesn’t just provide financial protection—it also plays a critical role in promoting climate resilience and encouraging farmers to adopt sustainable farming practices. By reducing the financial risks associated with agriculture, insurance can empower farmers to invest in improved technologies, better-quality seeds, and irrigation systems that help mitigate the effects of climate change.

In fact, according to a report by the Kenya Agricultural Insurance Program (KAIP), farmers with insurance are more likely to adopt climate-smart agriculture practices, such as using drought-resistant crop varieties or installing drip irrigation systems.

| Factor | Importance | Key Considerations |

|---|---|---|

| Coverage Options | High | Choose flexible coverage tailored to your specific farm type. |

| Premium Costs | Moderate | Compare costs but don’t compromise on coverage quality. |

| Claim Settlement Process | Very High | Look for fast and transparent claims processing. |

| Reputation & Reliability | Very High | Opt for well-reviewed, financially stable companies with a good track record. |

| Customer Support | Moderate | Accessible and responsive customer service is key. |

Factors Comparison Table

| Factor | Importance | Key Considerations |

|---|---|---|

| Coverage Options | High | Choose flexible coverage tailored to your specific farm type. |

| Premium Costs | Moderate | Compare costs but don’t compromise on coverage quality. |

| Claim Settlement Process | Very High | Look for fast and transparent claims processing. |

| Reputation & Reliability | Very High | Opt for well-reviewed, financially stable companies with a good track record. |

| Customer Support | Moderate | Accessible and responsive customer service is key. |

Additional Factors to Consider

- Exclusions and Limitations: Always read the fine print. Some policies may exclude specific types of risks, such as floods or theft, which may be important for your farm.

- Government Subsidies: The Kenyan government offers subsidized insurance programs through partnerships with private insurers, like the Kenya Livestock Insurance Program (KLIP). Check if you’re eligible for these programs to reduce premium costs.

- Bundled Insurance: Some companies offer bundled policies, where you can combine crop, livestock, and equipment insurance into a single, discounted package. This may offer better overall protection at a lower cost.

Top 5 Best Farm Insurance Companies in Kenya

When it comes to protecting your farm in Kenya, choosing the right insurance provider can make all the difference. After evaluating various companies based on coverage options, premium costs, reputation, and customer service, here are the top 5 best farm insurance companies in Kenya. These providers offer comprehensive protection tailored to the unique challenges of farming, from crop failures and livestock diseases to equipment damage and unpredictable weather conditions.

1. APA Insurance

APA Insurance is one of Kenya’s most reputable providers, offering a wide range of agricultural insurance products. They have a strong focus on both small-scale and large-scale farmers, and their farm insurance policies are designed to protect against natural calamities, diseases, and other unforeseen risks.

Key Coverage Options

- Crop Insurance: APA provides coverage for crop loss due to drought, flood, pest outbreaks, and other natural disasters. Their crop insurance policy covers high-risk crops such as maize, wheat, and tea.

- Livestock Insurance: This covers the death of livestock due to diseases, accidents, and theft. They offer specialized insurance for cattle, sheep, goats, and poultry.

- Greenhouse Insurance: APA Insurance also offers protection for greenhouses and their contents, including the plants and equipment within.

Why Choose APA Insurance?

- Wide variety of coverage tailored to the Kenyan agricultural sector.

- Quick and efficient claim settlement process, especially after widespread disasters.

- Well-reputed for their strong customer support and responsiveness.

Case Study: In 2021, after severe droughts affected maize farmers in Eastern Kenya, APA Insurance processed claims within a short period, enabling farmers to reinvest in seeds for the next planting season.

2. UAP Old Mutual

UAP Old Mutual is another leading insurance provider in Kenya, with a focus on agricultural insurance products aimed at minimizing risks in farming. They cover a variety of farming activities, including crop and livestock farming, horticulture, and aquaculture.

Key Coverage Options

- Crop Insurance: UAP’s crop insurance covers damage caused by drought, floods, hailstorms, and fire. It’s especially popular with farmers growing staple foods like maize and beans.

- Livestock Insurance: Their livestock coverage insures against loss from disease, accidents, and theft, and they also provide coverage for high-value animals like dairy cows.

- Aquaculture Insurance: UAP offers a unique aquaculture insurance product for fish farmers, covering risks such as disease, water contamination, and theft.

Why Choose UAP Old Mutual?

- Specialized coverage for diverse farming activities, including aquaculture.

- Strong financial backing, which guarantees the ability to pay out claims promptly.

- Customer education programs that help farmers reduce risks through best practices.

Bonus Tip: UAP Old Mutual also partners with the Kenya Livestock Insurance Program (KLIP) to offer subsidized insurance to pastoralists in drought-prone areas.

3. Jubilee Insurance

Jubilee Insurance is one of the oldest and most trusted insurance companies in Kenya. They have a robust farm insurance package aimed at both individual farmers and farming cooperatives. Their products focus on risk mitigation for crop and livestock farmers and provide peace of mind through tailored solutions.

Key Coverage Options

- Crop Insurance: Jubilee Insurance covers crop loss due to extreme weather, pests, and diseases. Their crop insurance is especially beneficial for horticulture farmers, covering high-value crops like flowers and vegetables.

- Livestock Insurance: Jubilee’s livestock insurance product covers death from accidents and diseases, including coverage for poultry, cattle, and small livestock like goats and sheep.

- Farm Machinery and Equipment: Jubilee also offers insurance for farm machinery such as tractors and irrigation systems, protecting against mechanical breakdown and theft.

Why Choose Jubilee Insurance?

- Trusted brand with decades of experience in agricultural insurance.

- Comprehensive coverage that includes both livestock and farm equipment.

- Excellent reputation for prompt claim payouts.

Data Insight: According to recent customer satisfaction surveys, Jubilee ranks highly for customer service and speedy claim settlements, making them a top choice for Kenyan farmers.

4. CIC Insurance

CIC Insurance has made a significant impact in Kenya’s agricultural sector by providing affordable farm insurance solutions. Their products are designed to cater to smallholder farmers, who make up a significant portion of the agricultural workforce in Kenya.

Key Coverage Options

- Crop Insurance: CIC’s crop insurance policy covers crops such as maize, wheat, and coffee. They focus on offering index-based insurance, which compensates farmers based on weather data like rainfall levels.

- Livestock Insurance: CIC insures livestock against death caused by disease, accidents, and theft. Their livestock insurance also covers costs related to the treatment of sick animals.

- Group Insurance: CIC provides group insurance products aimed at cooperatives and farmer groups, making it easier for small-scale farmers to access affordable coverage.

Why Choose CIC Insurance?

- Focuses on affordable solutions for small-scale farmers.

- Offers index-based insurance, which is particularly beneficial in regions prone to drought.

- Strong presence in rural areas, providing accessible services to remote farmers.

Fun Fact: CIC Insurance is one of the key players in offering subsidized insurance through the Kenya Agricultural Insurance Program, making insurance accessible to even the smallest farmers.

5. Heritage Insurance

Heritage Insurance offers specialized farm insurance products that cater to commercial and small-scale farmers. Their offerings are tailored for high-value farms, particularly in horticulture and cash crops such as tea and coffee.

Key Coverage Options

- Horticulture Insurance: Heritage offers insurance for high-value horticultural crops, including flowers, fruits, and vegetables. This covers loss due to weather events, diseases, and market fluctuations.

- Livestock Insurance: Their livestock insurance includes coverage for dairy and beef cattle, pigs, and poultry, protecting against diseases, theft, and accidents.

- Farm Property Insurance: Heritage also provides property insurance for farmhouses, barns, silos, and greenhouses, ensuring that farmers’ infrastructure is protected from fire, theft, and other risks.

Why Choose Heritage Insurance?

- Focus on high-value farms, especially in horticulture and cash crops.

- Excellent customer service and a reputation for personalized solutions.

- Offers protection for both farm produce and infrastructure, making it ideal for larger farms.

Pro Tip: Heritage Insurance is ideal for farmers looking for tailored coverage that includes both produce and physical assets like greenhouses and equipment.

| Insurance Company | Key Coverage Options | Ideal For | Notable Feature |

|---|---|---|---|

| APA Insurance | Crop, Livestock, Greenhouse Insurance | Small and large-scale farmers | Quick claim settlement after disasters |

| UAP Old Mutual | Crop, Livestock, Aquaculture Insurance | Farmers with diverse farming activities | Specialized aquaculture insurance |

| Jubilee Insurance | Crop, Livestock, Farm Machinery | Horticulture and livestock farmers | Comprehensive farm machinery coverage |

| CIC Insurance | Crop, Livestock, Group Insurance | Smallholder farmers and cooperatives | Affordable index-based insurance |

| Heritage Insurance | Horticulture, Livestock, Farm Property | High-value farms and commercial horticulture | Specialized high-value farm coverage |

Comparing Farm Insurance Coverage in Kenya

When choosing the right farm insurance, it’s crucial to understand what each provider offers. Here’s a comparison table summarizing the key features of the top 5 best farm insurance companies in Kenya:

| Insurance Company | Crop Insurance | Livestock Insurance | Special Features | Target Market |

|---|---|---|---|---|

| APA Insurance | Yes, covers multiple risks | Yes, theft and disease | Greenhouse insurance, quick claims | Small and large-scale farmers |

| UAP Old Mutual | Yes, covers multiple crops | Yes, for high-value animals | Aquaculture insurance, partnerships with KLIP | Diverse farming sectors |

| Jubilee Insurance | Yes, for high-value crops | Yes, includes poultry | Farm machinery coverage, trusted brand | Individual and cooperative farms |

| CIC Insurance | Yes, index-based options | Yes, treatment costs covered | Group insurance for cooperatives | Smallholder farmers |

| Heritage Insurance | Yes, horticulture-focused | Yes, for various livestock | Farm property insurance, high-value crop coverage | Commercial and cash crop farmers |

How to Choose the Right Farm Insurance for Your Needs

Choosing the right farm insurance requires careful consideration of your specific needs. Here are some essential factors to consider:

1. Assess Your Farming Operations

- Type of Farming: Consider whether you are engaged in crop farming, livestock rearing, or a mix of both. Different providers excel in different areas.

- Scale of Operations: Small-scale farmers may benefit from group insurance products, while larger farms might need comprehensive coverage.

2. Evaluate Coverage Options

- Look for policies that provide broad coverage for risks you face. Ensure that both crop and livestock insurance are included.

- Consider whether the provider offers specialized insurance for high-value crops or aquaculture if applicable to your operations.

3. Check Claim Processes

- Claim Settlement: Research how quickly the provider settles claims. Fast claim processing is crucial in times of crisis.

- Customer Support: Look for companies with a strong reputation for customer service to assist you through the claim process.

4. Review Premium Costs

- Compare premium costs across providers, but don’t just choose the cheapest option. Look for the best value based on the coverage provided.

5. Seek Recommendations

- Talk to other farmers or industry experts for insights and recommendations based on their experiences with different insurance providers.

6. Read Reviews and Testimonials

- Explore customer reviews online to gauge satisfaction levels and common issues with the companies you’re considering.

Conclusion

Selecting the right farm insurance is critical for safeguarding your investment and ensuring peace of mind. The top 5 best farm insurance companies in Kenya—APA Insurance, UAP Old Mutual, Jubilee Insurance, CIC Insurance, and Heritage Insurance—each offer unique features and benefits tailored to meet the diverse needs of farmers across the country.

By understanding the available options, assessing your specific needs, and choosing a provider with a solid reputation, you can secure your farm’s future against unforeseen risks. Remember, investing in farm insurance not only protects your livelihood but also contributes to the sustainability of the agricultural sector in Kenya.

Ultimate Guide to Agricultural Insurance in Kenya: Protect Your Farm and Future

Agriculture is the backbone of Kenya’s economy, contributing significantly to the GDP and providing employment to millions. However, the sector is fraught with challenges, including unpredictable weather patterns, pest infestations, and market fluctuations. This is where agricultural insurance comes into play, providing farmers with a safety net against unforeseen losses. In this guide, we will explore everything you need to know about agricultural insurance in Kenya.

Understanding Agricultural Insurance

Agricultural insurance protects farmers from potential losses due to adverse events that could affect their crops and livestock. It can cover a wide range of risks, including drought, floods, diseases, theft, and market price fluctuations. In Kenya, where the agricultural sector faces significant risks, insurance is essential for ensuring financial stability and food security.

Why is Agricultural Insurance Important?

-

Risk Management: Agricultural insurance helps farmers manage risks associated with farming activities. By protecting against loss, it allows farmers to invest in their businesses without the fear of total financial ruin.

-

Encourages Investment: With insurance in place, farmers are more likely to invest in modern farming techniques, improved seeds, and better equipment, knowing they have a safety net.

-

Supports Food Security: By stabilizing farmers’ incomes, agricultural insurance plays a crucial role in ensuring food security in Kenya, particularly in regions prone to climate change.

-

Boosts Credit Access: Farmers with insurance can secure loans more easily since lenders view them as lower-risk borrowers.

Types of Agricultural Insurance in Kenya

Agricultural insurance in Kenya is not a one-size-fits-all solution; instead, it encompasses various products tailored to meet the diverse needs of farmers. Here are the primary types of agricultural insurance available:

1. Crop Insurance

Crop insurance is designed to protect farmers from losses due to crop failure. This can be caused by natural disasters, pests, or diseases. In Kenya, crop insurance is essential due to the reliance on rain-fed agriculture, which is highly vulnerable to climate change. There are two main types of crop insurance:

-

Named Peril Insurance: Covers specific risks, such as drought or flood. For example, if a farmer’s crops are affected by drought, they can claim compensation.

-

Multi-Peril Insurance: Provides coverage against multiple risks, ensuring broader protection for farmers. This type is beneficial for those facing various challenges throughout the growing season.

2. Livestock Insurance

Livestock insurance protects farmers against losses incurred from the death or illness of their animals. Given that livestock farming is a significant source of income for many Kenyan families, this insurance is crucial. Key features include:

-

Coverage for Diseases: Many livestock policies cover major diseases like Foot and Mouth Disease (FMD), which can devastate herds.

-

Theft Protection: Farmers can also insure their animals against theft, a common issue in rural areas.

3. Horticultural Insurance

This type of insurance is tailored for farmers growing fruits, vegetables, and flowers. Horticultural crops often require specific coverage due to their sensitivity to weather conditions and market price fluctuations. Coverage includes:

-

Frost and Hail Damage: Protects against losses due to extreme weather conditions.

-

Market Price Fluctuation: Some policies may cover losses if the market price drops significantly after harvest.

4. Forestry Insurance

Forestry insurance protects tree crops, including timber and fruit trees, from loss due to fire, disease, or adverse weather conditions. Given the long-term investment required for forestry, this insurance is crucial for safeguarding these assets.

5. Agricultural Equipment Insurance

This insurance covers machinery and equipment used in farming. Given the significant investment in equipment, insurance helps mitigate losses due to theft, damage, or accidents.

6. Microinsurance

Microinsurance is a more affordable insurance option aimed at smallholder farmers. It typically has lower premiums and simpler terms, making it accessible to those who might otherwise be unable to afford traditional insurance products.

| Type of Insurance | Coverage |

|---|---|

| Crop Insurance | Protects against crop failure from various risks |

| Livestock Insurance | Covers loss from disease, death, and theft |

| Horticultural Insurance | Insures fruits, vegetables, and flowers against market fluctuations and weather damage |

| Forestry Insurance | Protects tree crops from fires and diseases |

| Agricultural Equipment Insurance | Covers machinery and equipment |

| Microinsurance | Affordable insurance for smallholder farmers |

Understanding the various types of agricultural insurance available is crucial for farmers to make informed decisions based on their unique needs and challenges. In Kenya, several insurance companies offer these products, which can significantly enhance farmers’ resilience against risks.

How to Choose the Right Agricultural Insurance Policy in Kenya

Choosing the right agricultural insurance policy can be overwhelming for farmers, especially with the variety of products available. Here are some essential factors to consider to ensure you select the most suitable insurance for your needs.

1. Assess Your Risks

Before purchasing any insurance, it’s vital to understand the specific risks associated with your agricultural practices. Consider the following:

-

Climate Vulnerabilities: Evaluate how climate change and weather patterns impact your farm. For instance, if you’re in a drought-prone area, multi-peril crop insurance might be essential.

-

Livestock Exposure: If you have livestock, assess the risks of diseases or theft. Livestock insurance can provide critical protection.

2. Understand Policy Types and Coverage

Familiarize yourself with the different types of agricultural insurance available (as discussed in the previous section). Ensure the policy you choose covers the specific risks you face. Pay attention to:

-

Exclusions: Understand what is not covered by the policy. This can help avoid surprises when filing a claim.

-

Payout Structure: Different policies have varying payout structures. Some may provide full coverage, while others may only cover partial losses.

3. Evaluate Premium Costs

Premiums can vary significantly between different insurance providers and policies. When evaluating costs:

-

Compare Premiums: Don’t just choose the cheapest option; consider the coverage offered and whether it meets your needs.

-

Understand Payment Terms: Know whether the premiums are payable annually or in installments and if there are any penalties for late payment.

4. Check the Insurer’s Reputation

The reputation of the insurance company matters. Consider:

-

Claim Settlement Ratio: Research how promptly and effectively the insurer settles claims. A higher ratio indicates reliability.

-

Customer Reviews: Look for feedback from other farmers regarding their experiences with the insurer. Online platforms and social media can be helpful for this.

5. Consult with Experts

Before making a decision, consult with agricultural experts or insurance brokers who specialize in agricultural insurance. They can provide valuable insights and help tailor policies to your specific situation.

6. Consider Subsidies and Government Support

The Kenyan government and various organizations provide support and subsidies to promote agricultural insurance among farmers. Investigate available programs that could help reduce your premium costs or enhance coverage.

- Agricultural Finance Corporation (AFC): They offer various financial products and services, including agricultural insurance assistance .

7. Review Policy Regularly

Once you have selected a policy, remember to review it regularly, especially if you make changes to your farming operations or if market conditions shift. This ensures that you maintain adequate coverage over time.

Summary of Choosing Agricultural Insurance

| Factor | Considerations |

|---|---|

| Assess Your Risks | Climate vulnerabilities, livestock exposure |

| Understand Policy Types | Coverage, exclusions, payout structure |

| Evaluate Premium Costs | Compare premiums, payment terms |

| Check the Insurer’s Reputation | Claim settlement ratio, customer reviews |

| Consult with Experts | Seek advice from agricultural experts or insurance brokers |

| Consider Subsidies | Explore government and organizational support programs |

| Review Policy Regularly | Adjust coverage as farming operations change |

Claims Process for Agricultural Insurance in Kenya

Understanding the claims process is crucial for farmers who invest in agricultural insurance. A smooth claims process can significantly reduce the stress of recovering losses due to unforeseen events. Here’s a detailed guide on how to navigate the claims process for agricultural insurance in Kenya.

1. Notification of Loss

The first step in the claims process is to notify your insurance provider as soon as you discover a loss. This should be done promptly, often within a specified timeframe outlined in your policy (usually within 24-72 hours). The notification can typically be done through:

- Phone Call: Contact your insurance agent or company directly.

- Written Notice: Some insurers may require a written notice, which you can send via email or post.

2. Documentation of Loss

Once you notify the insurer, you will need to provide detailed documentation to support your claim. Essential documents may include:

- Claim Form: Complete the insurer’s claim form accurately.

- Proof of Ownership: Provide receipts, contracts, or registration documents for crops or livestock affected.

- Photos and Videos: Capture visual evidence of the damage or loss.

- Inspection Reports: If applicable, obtain reports from agricultural extension officers or assessors regarding the cause and extent of the damage.

3. Claim Assessment

After submitting your claim, the insurance company will initiate an assessment process. This often includes:

- On-Site Inspection: An insurance adjuster may visit your farm to evaluate the extent of the loss.

- Investigation: The insurer may investigate the cause of loss to determine if it falls within the coverage limits. This could involve checking weather reports, pest infestations, or disease outbreaks.

4. Claim Approval and Payout

Following the assessment, the insurer will make a decision regarding the claim:

- Approval: If your claim is approved, you will receive a payout based on the terms of your policy. The amount will depend on the extent of the loss and the coverage limits.

- Denial: If the claim is denied, the insurer should provide reasons for the decision. You have the right to appeal or provide additional evidence if you believe the decision is unjust.

5. Receiving Compensation

Once approved, compensation is typically processed within a specific timeframe. This can vary depending on the insurer but is often completed within 30-60 days. Compensation can be received through:

- Bank Transfer: The most common method for receiving payouts.

- Cheque: Some insurers may issue a cheque for the approved amount.

6. Follow-Up

If you encounter delays or issues during the claims process, it’s essential to follow up regularly with your insurer. Maintain communication and ensure you have all necessary documentation at hand.

Important Considerations

- Read Your Policy Carefully: Understanding the terms and conditions, including deductibles and coverage limits, can significantly impact your claims experience.

- Keep Copies of All Correspondence: Documenting your communication with the insurer can be beneficial if disputes arise.

Summary of the Claims Process

| Step | Action Required |

|---|---|

| Notification of Loss | Contact the insurer promptly |

| Documentation of Loss | Provide all required documents |

| Claim Assessment | Insurer assesses the claim |

| Claim Approval and Payout | Receive compensation or appeal denial |

| Receiving Compensation | Compensation processed through bank or cheque |

| Follow-Up | Maintain communication with the insurer |

Challenges and Solutions in Agricultural Insurance in Kenya

Agricultural insurance is a crucial tool for farmers to mitigate risks. However, it faces several challenges in Kenya that can hinder its effectiveness. Understanding these challenges and potential solutions can help improve the agricultural insurance landscape.

1. Limited Awareness and Understanding

Many farmers, especially smallholders, lack awareness of the benefits of agricultural insurance. This leads to low uptake rates.

Solutions:

- Educational Campaigns: Government and insurance companies should run educational programs to inform farmers about the importance of insurance. These campaigns can include workshops, seminars, and community meetings.

- Use of Local Languages: Information should be provided in local dialects to ensure understanding among all farmers.

2. Affordability of Premiums

The cost of premiums can be prohibitive for smallholder farmers, limiting their ability to purchase insurance.

Solutions:

- Subsidized Premiums: The government can introduce subsidies to make premiums more affordable. For instance, the Kenyan government has provided subsidies in the past to encourage farmers to adopt insurance.

- Flexible Payment Plans: Insurers could offer flexible payment plans to accommodate farmers’ cash flow challenges, allowing them to pay premiums in installments.

3. Inadequate Data for Risk Assessment

The lack of accurate data on weather patterns, crop yields, and pest outbreaks makes it challenging for insurers to assess risks accurately.

Solutions:

- Investment in Data Collection: Both the government and private sectors should invest in technologies for data collection. Satellite imaging and climate monitoring can provide valuable insights for insurers.

- Collaboration with Research Institutions: Collaborating with agricultural research institutions can enhance data availability and accuracy, helping insurers develop better products.

4. Complexity of Policies

Many insurance policies are complex and difficult for farmers to understand, leading to confusion and mistrust.

Solutions:

- Simplified Policy Language: Insurers should strive to use plain language in their policies, avoiding technical jargon.

- Personalized Advisory Services: Insurance companies can offer personalized services where agents explain policies to farmers, ensuring they understand the coverage and terms.

5. Climate Change and Environmental Risks

The increasing unpredictability of weather patterns due to climate change poses a significant risk to agricultural production.

Solutions:

- Innovative Insurance Products: Insurers can develop new products that specifically address climate-related risks, such as index-based insurance, which pays out based on weather data rather than actual losses.

- Sustainability Practices: Promoting sustainable agricultural practices can help mitigate risks associated with climate change. This includes diversifying crops and improving soil health.

6. Insufficient Government Support

Limited government support can affect the growth and reliability of agricultural insurance schemes.

Solutions:

- Policy Frameworks: The government should develop robust policy frameworks that support agricultural insurance. This includes providing incentives for insurers and supporting public-private partnerships.

- Funding for Awareness Campaigns: Government funding can support awareness campaigns and education initiatives about the benefits of agricultural insurance.

Summary of Challenges and Solutions

| Challenge | Potential Solutions |

|---|---|

| Limited Awareness | Educational campaigns, use of local languages |

| Affordability of Premiums | Subsidized premiums, flexible payment plans |

| Inadequate Data | Investment in data collection, collaboration with research institutions |

| Complexity of Policies | Simplified language, personalized advisory services |

| Climate Change Risks | Innovative insurance products, promoting sustainability |

| Insufficient Government Support | Robust policy frameworks, funding for awareness campaigns |

The Future of Agricultural Insurance in Kenya

As the agricultural sector in Kenya continues to evolve, so does the landscape of agricultural insurance. Here, we explore the emerging trends, innovations, and potential future developments in agricultural insurance that can enhance its effectiveness and reach among farmers.

1. Technological Advancements

Technological innovation plays a crucial role in the future of agricultural insurance.

-

Mobile Insurance Solutions: With the high penetration of mobile phones in Kenya, insurers are increasingly leveraging mobile technology to reach farmers. Mobile platforms can facilitate easy access to insurance products, claim notifications, and premium payments. For example, services like M-Pesa allow farmers to manage their insurance policies conveniently.

-

Data Analytics and AI: Insurers are beginning to use data analytics and artificial intelligence (AI) to better assess risks and tailor products to individual farmer needs. By analyzing data on weather patterns, soil health, and crop performance, insurers can create more accurate risk profiles and pricing models.

2. Index-Based Insurance Products

Index-based insurance is gaining traction as a solution to the challenges posed by traditional insurance models.

-

Weather Index Insurance: This product pays out benefits based on predetermined weather conditions (like rainfall levels) rather than actual losses. This simplifies the claims process and helps farmers receive timely payouts, which is crucial for their recovery.

-

Area-Yield Index Insurance: This approach compensates farmers based on the average yield in a specific area. It can help mitigate the risks associated with individual farm losses, promoting a sense of community resilience.

3. Public-Private Partnerships

Collaboration between the government and private insurers is essential for the growth of agricultural insurance in Kenya.

-

Shared Risk Models: Public-private partnerships can help share risks and reduce the financial burden on insurers. The government can provide reinsurance or subsidies to encourage insurers to offer products to high-risk farmers.

-

Capacity Building: By working together, the government and private sector can implement training programs to educate farmers on the benefits of insurance and how to manage risks effectively.

4. Focus on Climate Resilience

As climate change continues to impact agriculture, the future of agricultural insurance must adapt accordingly.

-

Sustainable Agricultural Practices: Insurers can promote practices that enhance climate resilience, such as crop diversification, agroforestry, and conservation agriculture. These practices not only help farmers but also reduce risks for insurers.

-

Climate-Adapted Insurance Products: Developing insurance products that specifically address climate risks, such as drought or flooding, can provide farmers with the necessary support to withstand climate challenges.

5. Enhanced Regulatory Frameworks

A robust regulatory environment is vital for the sustainable growth of agricultural insurance.

-

Supportive Policies: The government needs to establish clear policies that encourage insurance uptake, protect farmers, and ensure transparency in operations.

-

Consumer Protection Laws: Strengthening consumer protection regulations can build trust in insurance products, making farmers more likely to invest in agricultural insurance.

Summary of Future Trends

| Trend | Description |

|---|---|

| Technological Advancements | Mobile solutions and AI for risk assessment |

| Index-Based Insurance Products | Weather and area-yield index insurance |

| Public-Private Partnerships | Collaboration to share risks and build capacity |

| Focus on Climate Resilience | Promoting sustainable practices and climate-adapted products |

| Enhanced Regulatory Frameworks | Supportive policies and consumer protection laws |

Conclusion

As we have explored throughout this guide to agricultural insurance in Kenya, understanding the nuances of agricultural insurance is essential for farmers looking to protect their livelihoods. The interplay of risks, the importance of insurance uptake, and the potential benefits highlight the critical role agricultural insurance can play in enhancing food security and improving farmers’ resilience.

Key Takeaways

-

Importance of Agricultural Insurance: Agricultural insurance serves as a vital tool for farmers, providing a safety net against unforeseen events such as droughts, floods, and pest invasions. By protecting their investments, farmers can focus on sustainable practices and growth.

-

Challenges to Adoption: Despite its benefits, challenges such as limited awareness, affordability, and policy complexity hinder the uptake of agricultural insurance. Addressing these challenges through education, financial incentives, and simplified policies is crucial.

-

Future Innovations: The future of agricultural insurance in Kenya looks promising, driven by technological advancements, public-private partnerships, and a focus on climate resilience. These innovations can help create more accessible and effective insurance products for farmers.

-

Regulatory Support: A supportive regulatory framework will be vital in fostering a healthy agricultural insurance market, encouraging participation, and ensuring consumer protection.

Farmers, policymakers, and stakeholders in the agricultural sector must work collaboratively to enhance the agricultural insurance landscape in Kenya. By investing in education, innovative insurance solutions, and sustainable agricultural practices, we can build a more resilient agricultural sector that benefits everyone.