Microinsurance Products Available for Farmers in Kenya

Microinsurance is a vital tool for smallholder farmers in Kenya, offering them a safety net against the unpredictable risks associated with agriculture. With agriculture and livestock contributing significantly to Kenya’s economy—accounting for about one-third of its annual output—farmers face increasing challenges due to climate change, market fluctuations, and natural disasters. Microinsurance products are designed to be affordable and accessible, providing essential coverage for farmers who often operate on tight budgets.

In this article, we will explore the various microinsurance products available for farmers in Kenya, their benefits, challenges, and how they can enhance financial security and resilience in the agricultural sector.

What is Microinsurance?

Definition of Microinsurance

Microinsurance refers to insurance products specifically designed to be affordable for low-income individuals or groups, particularly those who are often excluded from traditional insurance markets. Unlike conventional insurance, which may require high premiums and complex policies, microinsurance aims to provide simple, low-cost coverage that meets the unique needs of smallholder farmers.

Importance of Microinsurance for Farmers

Microinsurance plays a crucial role in enhancing financial security for farmers. It allows them to manage risks effectively and encourages them to invest in better agricultural practices and inputs. By mitigating the financial impact of crop failures or livestock losses, microinsurance helps stabilize farmers’ incomes and promotes sustainable agricultural practices.

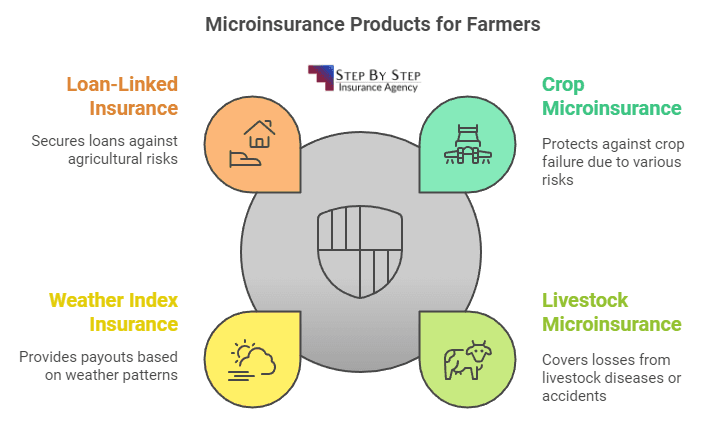

Types of Microinsurance Products Available for Farmers in Kenya

1. Crop Microinsurance

Crop microinsurance is tailored to protect farmers against losses due to adverse weather conditions, pests, and diseases. Notable products include:

- Kilimo Salama: This program offers weather-indexed crop insurance that compensates farmers based on rainfall data rather than actual crop damage assessments. By using automated weather stations and mobile technology, Kilimo Salama has insured over 187,000 farmers since its inception.

- Bima Pima: Translated as “insurance in affordable bits,” Bima Pima allows farmers to purchase scratch cards that provide insurance coverage when they buy seeds or fertilizers. The initial premium can be as low as KES 50 (approximately $0.50), making it accessible for many smallholders.

2. Livestock Microinsurance

Livestock microinsurance protects farmers from losses related to their animals due to diseases or accidents. Key offerings include:

- Dairy Livestock Insurance: This product is designed for dairy farmers who supply milk to cooperatives. It covers losses due to illness or death of high-yield cows and is often bundled with veterinary services

. - Loan-Linked Insurance: This type of insurance is linked to loans taken by farmers for purchasing livestock. It ensures that if the farmer suffers a loss, the insurance covers the loan repayment, thus protecting both the farmer and the lending institution.

3. Weather Index Insurance

Weather index insurance is an innovative product that provides payouts based on specific weather conditions rather than actual losses. This type of insurance is particularly beneficial in areas prone to drought or excessive rainfall. Farmers receive compensation based on data collected from weather stations or satellite imagery. This approach reduces the need for costly loss verification processes.

4. Loan-Linked Insurance

Loan-linked insurance products are designed specifically for smallholders who have taken out loans for agricultural inputs. These products ensure that if a farmer suffers a loss due to adverse conditions, the insurance compensates them enough to cover their loan obligations.

Key Providers of Microinsurance in Kenya

a. ACRE Africa

ACRE Africa is one of the largest micro-insurance providers in Africa and plays a significant role in offering tailored solutions for Kenyan farmers. Their innovative approach includes using satellite data and mobile technology to assess risks and provide timely payouts.

b. Kilimo Salama

Kilimo Salama has been a pioneer in providing accessible crop insurance through its unique model that combines technology with traditional farming practices. By eliminating on-site inspections through automated weather data collection, Kilimo Salama has made it possible for more farmers to access insurance.

c. Pula Advisors

Pula Advisors focuses on bundling agricultural inputs with insurance products. They work closely with seed companies and other suppliers to offer free insurance coverage as part of their product offerings. This model not only protects farmers but also encourages them to invest in quality seeds and fertilizers.

Benefits of Microinsurance for Farmers

Microinsurance provides numerous advantages that can significantly impact smallholder farmers:

1. Financial Protection

Microinsurance acts as a safety net against unexpected losses. By providing compensation during adverse conditions, it helps stabilize farmers’ incomes and reduces vulnerability.

2. Increased Investment in Agriculture

With the assurance that they will be compensated for losses, farmers are more likely to invest in high-quality seeds, fertilizers, and modern farming techniques. This investment can lead to increased productivity and better yields.

3. Improved Food Security

By protecting farmers’ livelihoods, microinsurance contributes to overall food security within communities. When farmers can sustain their production levels despite challenges, it ensures a steady supply of food.

Challenges Facing Microinsurance Uptake in Kenya

Despite its benefits, several challenges hinder the widespread adoption of microinsurance among Kenyan farmers:

1. Awareness and Education

Many farmers are unaware of available microinsurance products or do not understand how they work. Education initiatives are crucial for increasing uptake.

2. Affordability Concerns

While microinsurance is designed to be affordable, some farmers still find it challenging to pay premiums due to their limited income.

3. Accessibility Issues

Geographic barriers can limit access to microinsurance products. Farmers in remote areas may struggle to find providers or may not have access to mobile technology necessary for purchasing policies.

How to Access Microinsurance Products in Kenya

Farmers interested in accessing microinsurance products can follow these steps:

- Research Available Products: Start by researching different microinsurance options that suit your farming needs.

- Contact Local Providers: Reach out to local agribusinesses or cooperatives that offer microinsurance.

- Complete Necessary Documentation: Fill out any required forms and provide necessary information about your farm.

- Pay Premiums: Make sure you understand the premium payment process—many providers allow payments through mobile money platforms.

Case Studies: Success Stories from Kenyan Farmers

Example 1: Jacob Wambua’s Dairy Farm Success

Jacob Wambua is a successful dairy farmer who has benefited significantly from taking up livestock microinsurance. Operating in Machakos County—a region prone to drought—Wambua faced numerous challenges due to climate variability. However, by enrolling in an insurance program offered through his cooperative, he was compensated when he lost cows due to disease. This financial support allowed him not only to recover but also expand his herd size and increase milk production.

“Insurance has given me peace of mind,” says Wambua. “I know I can invest confidently knowing I have protection against unforeseen events.”

Example 2: Impact of Bima Pima on Smallholder Farmers

Farmers using Bima Pima have reported substantial improvements in their farming outcomes. For instance, Mary Mate from Embu County shared her experience after receiving compensation through her Bima Pima policy when drought affected her crops. The quick payout allowed her to replant immediately, resulting in a successful harvest later that season.

Conclusion

Microinsurance products available for farmers in Kenya represent a transformative solution aimed at enhancing resilience against climate change and financial instability. By providing affordable coverage tailored specifically for smallholder needs, these products empower farmers like Jacob Wambua and Mary Mate to manage risks effectively while investing confidently in their agricultural practices.

As awareness grows around these innovative solutions, it is crucial for stakeholders—including government agencies, NGOs, and private sector players—to collaborate further in promoting microinsurance uptake among Kenyan farmers.