Banks Increasing Market Share in Insurance: The Rise of Bancassurance in Kenya

In recent years, the banking and insurance sectors in Kenya have witnessed a significant transformation, with banks increasingly entering the insurance market through a model known as bancassurance. This innovative partnership allows banks to sell insurance products alongside their traditional financial services, effectively diversifying their offerings and enhancing customer loyalty.

Currently, bancassurance accounts for approximately 10% of the insurance market in Kenya, reflecting a growing trend driven by the insuring of vehicles, loans, and mortgages. This article delves into the rise of bancassurance in Kenya, exploring its benefits, current market dynamics, and the factors fueling its growth.

Understanding Bancassurance

Definition of Bancassurance

Bancassurance is a strategic alliance between banks and insurance companies that enables banks to distribute insurance products to their customers. This partnership allows banks to leverage their existing customer base and distribution channels to offer a range of insurance products, including life, health, property, and motor insurance. By integrating insurance into their service portfolio, banks can provide a more comprehensive financial solution to their clients.

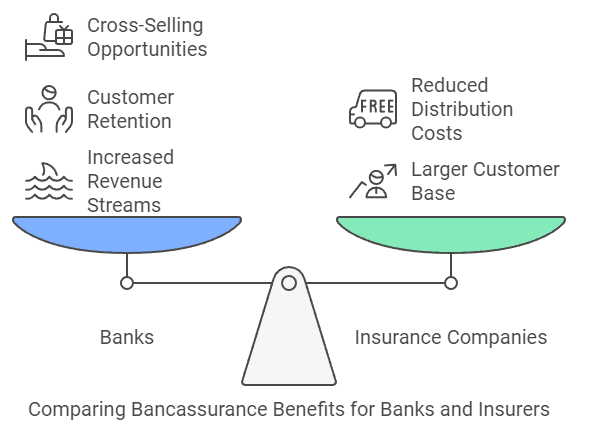

Benefits of Bancassurance for Banks

- Increased Revenue Streams: Bancassurance provides banks with an additional source of income through commissions earned on insurance sales. This diversification helps banks mitigate risks associated with fluctuations in traditional banking revenue.

- Customer Retention: By offering a one-stop-shop for financial services, banks enhance customer loyalty. Clients are more likely to stay with a bank that meets multiple financial needs, including insurance.

- Cross-Selling Opportunities: Banks can utilize their existing relationships with customers to cross-sell insurance products. For instance, when a customer applies for a loan or mortgage, the bank can offer relevant insurance products simultaneously.

Benefits of Bancassurance for Insurance Companies

- Access to a Larger Customer Base: Insurance companies benefit from banks’ extensive networks and customer databases, allowing them to reach more potential clients than they could through traditional distribution channels.

- Reduced Distribution Costs: By partnering with banks, insurers can lower their marketing and distribution expenses. Banks already have established infrastructure and client relationships that insurers can leverage.

Current State of the Insurance Market in Kenya

Overview of the Kenyan Insurance Market

The Kenyan insurance market has experienced steady growth over the past decade. As of 2023, the market is valued at approximately KES 300 billion (around USD 2.5 billion), with various segments including life insurance, health insurance, and general insurance contributing to this figure. The penetration rate remains low compared to global standards; however, there is significant potential for growth as awareness increases and new products are introduced.

Role of Banks in the Insurance Market

Historically, banks in Kenya have engaged with the insurance sector primarily through referrals or partnerships without significant involvement in selling policies directly. However, recent trends indicate a shift toward active participation in bancassurance as banks recognize the potential for increased profitability and customer engagement.

Drivers of Growth in Bancassurance

a. Insuring Vehicles

The rise in vehicle ownership in Kenya has led to increased demand for motor insurance. According to recent statistics from the Kenya National Bureau of Statistics (KNBS), vehicle registrations have surged by over 20% annually. Banks are capitalizing on this trend by integrating motor insurance into vehicle financing packages, ensuring that borrowers are adequately insured while also protecting their loan investments.

b. Loans and Mortgages

As personal and business loans become more prevalent among Kenyans seeking financial support for various projects, insuring these loans has become essential. Banks offer loan-linked insurance policies that protect both the borrower and the lender from potential losses due to defaults or unforeseen circumstances such as death or disability. This integration not only safeguards the bank’s interests but also provides peace of mind for borrowers.

c. Digital Transformation

The digital revolution is reshaping how bancassurance operates in Kenya. Many banks are adopting technology-driven solutions that facilitate seamless integration between banking services and insurance products. Mobile banking applications now often include options for purchasing or managing insurance policies directly from users’ smartphones. This convenience is attracting tech-savvy customers who prefer managing their finances digitally.

d. Regulatory Environment

The regulatory framework surrounding bancassurance in Kenya has evolved to encourage collaboration between banks and insurers. The Insurance Regulatory Authority (IRA) has implemented guidelines that facilitate these partnerships while ensuring consumer protection. These regulations help create a conducive environment for bancassurance growth by establishing clear standards for product offerings and sales practices.

Case Studies: Successful Bancassurance Models in Kenya

Case Study 1: KCB Bank and its Insurance Offerings

KCB Bank has emerged as a leader in the bancassurance space in Kenya. Through its partnership with various insurance providers, KCB offers a wide range of products including life insurance, health coverage, and motor insurance. The bank’s approach focuses on integrating these offerings into its loan products—ensuring that customers are informed about relevant insurance options when they apply for financing.As a result of these initiatives, KCB has reported significant growth in its market share within the bancassurance sector. In 2023 alone, KCB’s bancassurance revenue increased by 25%, highlighting the effectiveness of this model in enhancing customer engagement and profitability.

Case Study 2: Equity Bank’s Innovative Insurance Products

Equity Bank has also successfully leveraged bancassurance to expand its service offerings. The bank collaborates with leading insurers to provide tailored products such as microinsurance aimed at low-income earners and smallholder farmers. By bundling these products with loans or savings accounts, Equity Bank has been able to attract new customers while retaining existing ones.This innovative approach has resulted in a notable increase in customer acquisition rates—particularly among underserved populations who previously lacked access to affordable insurance options.

Challenges Facing Bancassurance in Kenya

1. Customer Awareness and Education

Despite its growth potential, one of the significant challenges facing bancassurance is low customer awareness about available products. Many consumers do not fully understand how bancassurance works or the benefits it offers. Educational initiatives are crucial for increasing uptake among potential clients.

2. Competition from Traditional Insurance Channels

Traditional insurers view bancassurance as competition that threatens their market share. As banks continue to expand their presence in this space, traditional insurers may respond by enhancing their own distribution strategies or developing competitive products tailored specifically for direct sales.

3. Regulatory Hurdles

While regulations have generally supported bancassurance growth, changes in policy can present challenges for both banks and insurers. Adapting to new regulatory requirements can be resource-intensive and may slow down product development cycles.

Future Outlook for Bancassurance in Kenya

Trends Shaping the Future

The future of bancassurance in Kenya looks promising as more banks recognize its potential benefits. Predictions suggest that by 2025, bancassurance could account for up to 15% of the total insurance market share due to increasing consumer demand for integrated financial services.

Strategic Recommendations for Banks and Insurers

To maximize opportunities within this growing sector, it is essential for banks and insurers to collaborate closely on product development and marketing strategies. Joint training programs can help staff from both sectors understand each other’s offerings better—ultimately leading to improved customer service and satisfaction.

Conclusion

Bancassurance represents an exciting opportunity for both banks and insurers in Kenya as they work together to meet evolving consumer needs within an increasingly competitive landscape. By integrating banking services with comprehensive insurance offerings—particularly in areas like vehicle financing and loan protection—these institutions can enhance customer loyalty while driving revenue growth.

As awareness around bancassurance continues to grow among consumers and regulatory frameworks evolve to support this model further, it is clear that this partnership will play an integral role in shaping the future of financial services in Kenya.

FAQs about Bancassurance in Kenya

- What is bancassurance?

- Bancassurance is a partnership between banks and insurance companies that allows banks to sell insurance products alongside traditional banking services.

- How does bancassurance benefit consumers?

- It provides consumers with convenient access to various financial services under one roof while often offering competitive pricing on bundled products.

- What types of insurance can be accessed through bancassurance?

- Consumers can access various types of insurance through bancassurance including life insurance, health coverage, motor insurance, property insurance, and loan-linked policies.

- Are there any risks associated with bancassurance?

- Risks include potential conflicts of interest where banks may prioritize selling certain products over others based on profitability rather than consumer needs.