How Medical Insurance Providers in Kenya Support International Medical Coverage

Navigating international medical coverage is essential for Kenyans who frequently travel, work abroad, or have family members living in other countries. Medical insurance providers in Kenya offer various options that extend beyond borders, ensuring access to quality healthcare no matter where individuals are in the world. In this post, we’ll explore how these providers support international medical coverage, including policy details, benefits, and additional services that cater to Kenyans with global needs.

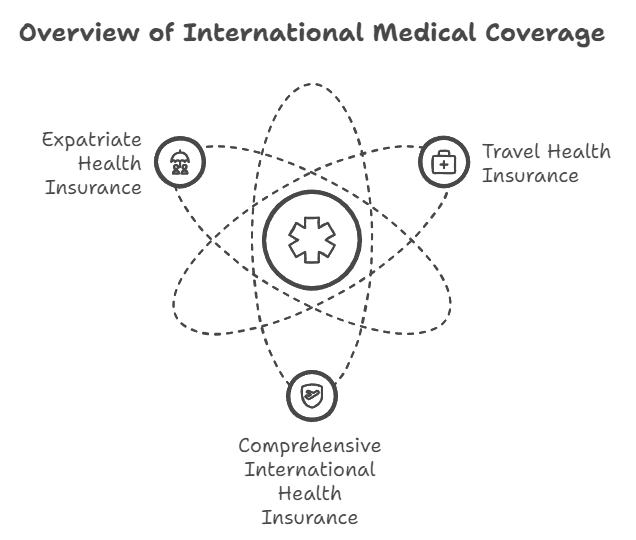

1. Types of International Medical Coverage Available

- Travel Health Insurance: Designed for short-term travel, typically covering emergency medical treatments, hospital stays, and sometimes medical evacuations. It’s ideal for vacations or short business trips, where you might need emergency assistance.

- Comprehensive International Health Insurance: Aimed at those working or residing abroad for extended periods, this option provides broader coverage. It includes access to preventive care, chronic illness management, and sometimes wellness programs.

- Expatriate Health Insurance: Tailored to long-term stays abroad, expat health insurance is a common option for Kenyans moving internationally for work or study, ensuring they have comprehensive medical support abroad.

For instance, Britam offers international health plans in collaboration with global insurers like Allianz, while firms such as ICEA Lion provide international health plans with customizable options for both short-term travelers and expatriates. These plans vary, so it’s crucial to review each provider’s options to select the one that best suits your needs.

2. Network of Global Medical Partners

- Kenyan insurers often collaborate with global networks, ensuring seamless access to healthcare across different countries. Partnerships with organizations such as GeoBlue and Allianz enhance access to reputable hospitals and medical facilities worldwide. These networks help policyholders locate in-network providers, minimizing out-of-pocket expenses and offering smooth access to necessary medical care.

- Additionally, network partnerships provide emergency evacuation and repatriation services, crucial for emergencies in remote or under-resourced areas.

For instance, GeoBlue, partnered with Blue Cross Blue Shield, provides extensive global networks that Kenyan insurers can leverage to guarantee quality medical services for their policyholders abroad. IMG and Allianz are also notable for their expansive healthcare networks globally.

3. Emergency Medical Evacuation and Repatriation Services

- Emergency evacuation is often necessary for individuals in critical medical situations who require immediate transfer to specialized healthcare facilities not available in their current location. Most international medical plans from Kenyan insurers include this service, ensuring prompt, life-saving transportation.

- Repatriation services, which cover the transportation of policyholders back to Kenya for continued treatment, are also included in many plans. This is particularly beneficial for those facing long-term treatments and wishing to recover near family or within their home healthcare system.

Companies like Jubilee Insurance offer evacuation and repatriation services, particularly for high-risk travel areas. ICEA Lion also includes these services within their international plans, helping ensure that Kenyans receive necessary medical support wherever they are.

4. Customizable Plans for Unique Needs

- Kenyan insurance providers frequently offer customizable plans, catering to the specific needs of frequent travelers, students, expatriates, and business professionals. Policyholders can often choose from a range of benefits, including routine check-ups, dental care, chronic illness management, and maternity coverage.

- Some providers offer additional options for wellness programs and mental health services, ensuring a holistic approach to health management.

UAP Old Mutual, for example, allows clients to adjust coverage based on the destination and length of stay, catering to students, expats, and global employees. By understanding the different plan components, Kenyans can tailor their coverage to align with personal health and financial needs.

5. Digital Tools and Support Services

- Digital platforms and mobile applications are increasingly common among Kenyan insurance providers offering international coverage. These tools assist policyholders in managing their plans, finding local providers, and handling claims from anywhere in the world.

- Many insurers also provide 24/7 customer support hotlines to address emergencies, language barriers, and logistical concerns when abroad. These services ensure that Kenyans can quickly access help and submit claims without complex paperwork.

For instance, Britam and AAR Insurance offer mobile-friendly options for their clients to access policy details, file claims, and receive support while traveling. GeoBlue’s Destination Dashboard also provides valuable resources for understanding healthcare needs based on location, with wellness tips and provider directories.

Conclusion

International medical coverage from Kenyan insurers is comprehensive, offering varied plans suited for different global needs, from short-term travel insurance to comprehensive expatriate health insurance. The right plan depends on your travel frequency, location, and healthcare requirements, and understanding these factors ensures that you or your loved ones have secure medical support worldwide. Kenyan insurance providers are expanding their networks, digital tools, and customization options to make international medical coverage accessible and user-friendly for all global citizens.

For more detailed insights on travel and expatriate insurance options, visit Britam or explore GeoBlue’s comprehensive global insurance offerings.

6. Cost of International Medical Coverage and Budgeting Tips

- Premiums and Deductibles: When selecting international medical insurance, understanding the balance between premiums and deductibles is essential. Lower premiums often mean higher deductibles and vice versa. Kenyan providers typically offer tiered plans with flexible deductible options, which allow policyholders to adjust based on their budgets and anticipated needs.

- Coverage Limits and Exclusions: Reviewing coverage limits for hospital stays, surgeries, and outpatient care is crucial. Some plans also cap benefits for specific services, such as mental health or maternity care. Additionally, policyholders should be aware of exclusions, such as coverage for pre-existing conditions, which may differ by provider and plan type.

- Cost Comparison Among Providers: It’s wise to compare costs across multiple Kenyan insurers that offer international coverage to find a plan that offers the best value for the price. Look at premium costs, deductible flexibility, and the extent of coverage.

According to Jubilee Insurance and Britam, factors affecting the cost of coverage include age, destination, and the level of desired coverage. Policyholders can often reduce costs by opting for higher deductibles or choosing plans with narrower coverage.

7. Navigating the Claims Process for International Coverage

- Documentation Required for Claims: For international claims, clear and thorough documentation is essential. Policyholders should retain receipts, medical reports, and other proof of services provided. Most Kenyan insurers simplify this process by providing claim forms and guidelines for international claims online.

- Direct Billing vs. Reimbursement: Some providers have direct billing agreements with hospitals and healthcare facilities in their networks, meaning the provider will pay the hospital directly, sparing the policyholder upfront costs. In areas without network facilities, policyholders may have to pay out of pocket and submit claims for reimbursement.

- Assistance with Language and Documentation: Some insurers provide multilingual support to help policyholders in non-English-speaking countries. Additionally, support for translating documents or communicating with foreign providers is often available.

For example, AAR Insurance and ICEA Lion offer clear guidelines for submitting claims online, and many Kenyan insurers partner with global networks that provide support and smooth out claims handling internationally.

8. Benefits of International Coverage for Frequent Travelers and Expats

- Peace of Mind for Frequent Travelers: Whether for leisure or work, frequent travelers can avoid medical uncertainties abroad with international coverage. Coverage benefits include access to emergency services, preventive care, and routine health screenings, ensuring travelers’ well-being in unfamiliar locations.

- Comprehensive Care for Expats: For those relocating abroad, comprehensive international coverage protects against unexpected medical costs and provides a high level of care. Expat-focused plans include options for continuous care, often tailored to chronic conditions or specialized treatments, and they can be adjusted as needed to suit different international destinations.

- Ease of Access and Reduced Costs: Without international medical coverage, accessing healthcare abroad can be costly. Having insurance reduces the burden of unexpected expenses and guarantees access to quality services.

As GeoBlue notes, individuals without international coverage can face prohibitive medical costs for routine and emergency services abroad. This added layer of protection supports long-term financial planning, particularly for Kenyans living or working internationally.

9. Important Considerations Before Choosing an International Medical Plan

- Assessing Personal Health Needs: Individuals with chronic health conditions, frequent travelers, or those moving to higher-risk areas may require specific coverage features. Policies with comprehensive chronic illness management and access to specialists may be especially beneficial.

- Evaluating Coverage by Destination: Different countries have varied healthcare systems, and some may be costlier than others. Kenyan insurers can adjust their plans based on specific destination needs, allowing for customized levels of coverage.

- Reviewing Terms and Conditions Closely: Be mindful of terms surrounding pre-existing conditions, claim limits, and exclusions. Ensure the plan aligns with personal medical requirements and intended destinations.

- Comparing Customer Support and Digital Accessibility: Since medical emergencies can happen anytime, select a provider with robust 24/7 customer support, digital tools, and quick claim processing. Many Kenyan insurers offer mobile apps, online claim portals, and dedicated helplines.

The Association of Kenya Insurers (AKI) suggests individuals carefully review plan details and choose coverage that matches their health, budget, and travel needs. Comparing options based on these factors can help ensure comprehensive, affordable international healthcare.

Conclusion

International medical coverage offers Kenyan travelers, expatriates, and business professionals valuable peace of mind, access to quality healthcare, and financial protection. By understanding the types of coverage, networks of global medical partners, claim processes, and additional services, individuals can select the most suitable plan for their global needs. The comprehensive international options offered by Kenyan providers reflect a commitment to supporting Kenyans wherever they may go.